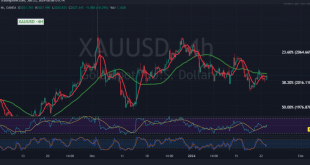

Gold prices demonstrated limited movements in the previous trading session, characterized by a prevailing downward trend. As highlighted earlier, breaching the 2016 level aims for a touchpoint at 2005, potentially reaching its lowest level at $2009 per ounce. From a technical standpoint, the price has returned to stability above the …

Read More »Gold: Resuming the decline requires confirmations 25/1/2024

The resistance point highlighted in the previous technical report at the price of 2034 successfully impeded the upward trend temporarily. As mentioned yesterday, a prudent approach is to closely observe price behavior. A drop below 2016 could signify a shift towards a downward trend, with an initial target of 2009 …

Read More »Market Drivers – US Session, Jan. 24

A growing appetite for riskier assets caused gold prices to retreat during the North American session, closing in on the $2010 area. The recovery of interest in the risk complex put pressure on the dollar and drove the EUR/USD pair above 1.0900. News of further stimulus in China from the …

Read More »Gold is still waiting for a signal to move 24/1/2024

The technical outlook for gold has experienced little change, with the precious metal trading within a narrow range for the third consecutive session, bound by support near 2016 and resistance around 2034. In a detailed analysis based on the 240-minute time frame chart, the price has found stability above the …

Read More »Gold is waiting for a trend confirmation signal 23/1/2024

Gold has been trading within a narrow range, confined below the strong support level of 2016 and above the sub-resistance level at 2032, showing little significant change in its movements. In terms of technical analysis on the 240-minute time frame chart, the price has returned to stability above the 2016 …

Read More »Financial Markets’ Weekly Recap

The performance of financial markets exhibited a range of dynamics over the past week. Notably, strength was observed in the performance of oil and the dollar, while gold experienced a marginal decline in its gains. Several key factors acted as primary drivers influencing market movements. Among these, the ongoing Red …

Read More »Gold is waiting for a stronger trend signal 19/1/2024

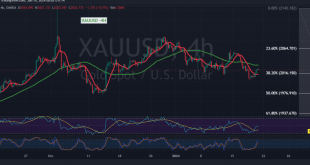

Gold prices experienced a modest upward rebound in the last trading session, attempting to build on the previously established bottom around $2000. In our prior technical report, we highlighted that the consolidation of prices above 2016, and more significantly 2025, could potentially halt the possibility of a further decline. Examining …

Read More »Gold is touching targets 18/1/2024

Gold prices experienced significant losses in the last trading session, aligning with the anticipated negative trend outlined in the previous technical report. The prices touched the official target by breaking the support at $2016, reaching $2000 per ounce. In the current technical analysis, focusing on the 240-minute chart, the price …

Read More »Gold retreats as fresh US data boosts US dollar

Strong US Retail Sales figures and a spike in US Treasury yields have continued to drive down gold prices, which have lost more than 1.11% of their value. Gold’s decrease is partly due to the US Dollar Index’s upward trajectory, which reached a five-week high, and hawkish remarks made by …

Read More »Gold achieves the target and confirms breaking the support 17/1/2024

Gold prices experienced negative trading in line with the expected downward trajectory outlined in yesterday’s technical report, reaching the designated target at $2037 and marking a low at $2024 per ounce. Analyzing the 4-hour chart today reveals stability in trading below the support level of 2037, with gold still under …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations