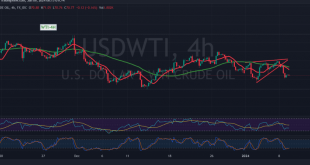

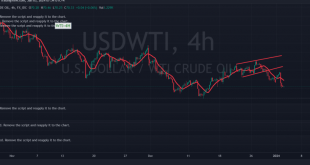

US crude oil futures exhibited mixed trading in the previous session, eventually returning to an upward trend after finding support around the pivotal level of 71.20. From a technical standpoint, there is a cautious positive outlook. The price is receiving positive signals from the simple moving averages, which have provided …

Read More »Gold: Technical Signals Indicate Conflicting Trends, Await Key Breakouts 12/1/2024

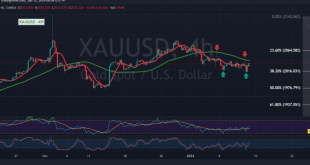

Gold experienced a downward trend in the previous trading session, testing the main support around 2016, before concluding the day’s trading above this support and embarking on an upward rebound, targeting a retest of 2035. Analyzing the 240-minute chart, conflicting technical signals emerge. The 50-day simple moving average poses a …

Read More »CAD facing temporary negative pressure 9/1/2024

The Canadian dollar continues to exhibit an upward trend, in line with the anticipated bullish context outlined in the previous technical report. The pair successfully established a base around the support level of 1.3320. In terms of technical analysis, a closer examination of the 4-hour time frame chart reveals ongoing …

Read More »Oil maintains negative stability 9/1/2024

US crude oil futures prices experienced significant losses as the current week’s trading sessions commenced, aligning with the anticipated negative outlook and reaching the targeted level of $70.00. The recorded lowest level was $70.13 per barrel. Technically, the prevailing sentiment leans towards negativity, with the formation of simple moving averages …

Read More »Gold is at crucial levels in the short term 9/1/2024

Gold prices recently touched the designated support level, established at the 2016 price, reaching a low of $2016 per ounce. The technical analysis indicates a subsequent upward rebound following this contact with the robust 2016 support level, prompting a retest of the 2040 resistance level. Examining the 4-hour time frame …

Read More »CAD hits the desired target 3/1/2024

The Canadian dollar exhibited an upward trend, in line with expectations mentioned in the previous technical report, reaching the official target station at the price of 1.3320 and recording its highest level at 1.3340. From a technical analysis perspective today, upon closer examination of the 4-hour time frame chart, it …

Read More »Oil suffers huge losses 3/1/2024

Oil prices did not align with the positive outlook as anticipated, which was based on the assumption of trading stability above the psychological barrier support level of 71.00 at the time of the report’s issuance. The report highlighted that a return to trading stability below 71.00 would cease attempts to …

Read More »Gold gets a negative signal 3/1/2024

Gold prices exhibited diverse movements, initially achieving the first upward target as indicated in the previous report, reaching the price of 2076 and marking a peak at 2078. However, subsequent negative pressure led to a decline, and the price recorded $2055 per ounce. From a technical analysis perspective today, a …

Read More »CAD trying to recover 2/1/2024

Following several consecutive sessions of decline, the Canadian dollar has discovered a robust support base around 1.3180. Benefiting from this foundation, it is now making efforts to initiate a bullish rebound to the upside. From a technical analysis perspective today, a closer examination of the 4-hour time frame chart reveals …

Read More »Oil is trying to form a rising wave 2/1/2024

The most recent technical analysis report suggests that triggering selling positions hinges on breaking the 73.30 level, potentially initiating a downward trajectory for oil. In this scenario, the initial targets lie at 72.50, with the possibility of reaching its lowest point at $71.30 per barrel. From a technical standpoint, our …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations