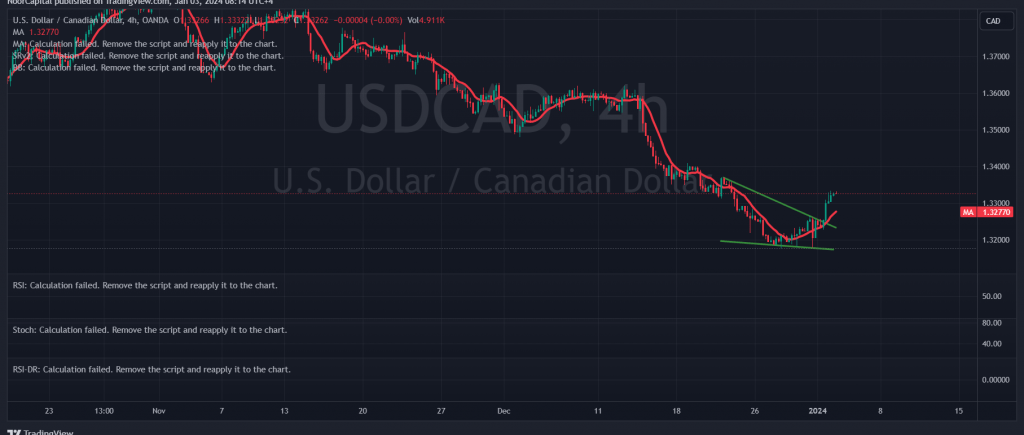

The Canadian dollar exhibited an upward trend, in line with expectations mentioned in the previous technical report, reaching the official target station at the price of 1.3320 and recording its highest level at 1.3340.

From a technical analysis perspective today, upon closer examination of the 4-hour time frame chart, it is noted that the Relative Strength Index (RSI) continues to provide positive signals. Additionally, the pair is receiving positive stimulus from the 50-day simple moving average.

With the stability of trading above 1.3250, there is encouragement to maintain positive expectations. The initial target is set at 1.3370, and breaking this level serves as a motivating factor that enhances the likelihood of a further rise towards 1.3410.

On the downside, confirmation of breaking the support floor of 1.3200 would delay the chances of a rise, leading to a retest of 1.3200 before potential attempts to rise again.

A cautionary note is warranted today as high-impact economic data related to the American economy (FOMC Minutes, ISM Manufacturing PMI, and JOLTS Job Openings) is anticipated. This may result in increased volatility during the release of these news items. Traders are advised to exercise vigilance and consider the potential market reactions to these events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations