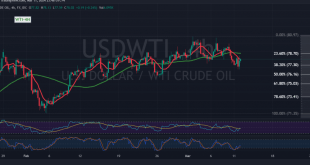

Mixed trading characterized the movement of US crude oil futures contracts in the previous trading session, reflecting attempts to breach the key resistance level at 78.50. From a technical standpoint, intraday oil price movements indicate a temporary return to stability above 77.80, accompanied by the Relative Strength Index showing tentative …

Read More »Gold continues to maintain its gains 12/3/2024

Gold prices have sustained their impressive rally into the second consecutive week, reaching a pinnacle during the initial trading sessions of this week at $2,189 per ounce, marking a new record high. Today’s technical analysis, focusing on the 4-hour timeframe chart, reveals that the simple moving averages remain supportive of …

Read More »CAD hits the resistance 7/3/2024

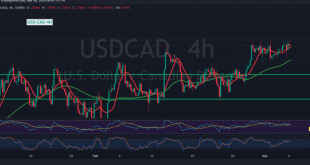

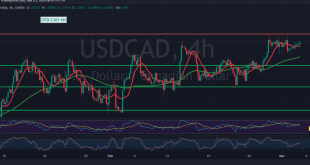

The Canadian dollar pair encountered significant resistance at the psychological barrier level, failing to breach it and subsequently experiencing negative pressure, leading to a downward movement to retest 1.3500. Today’s technical analysis suggests a bearish outlook, with emphasis on the intraday stability below the 1.3570 resistance level. Additionally, negative indications …

Read More »Oil needs additional momentum to continue rising 7/3/2024

During the previous trading session, US crude oil futures prices experienced significant gains as they breached the 78.50 level, advancing towards the upward target of 80.30, reaching a peak of $80.65 per barrel. Technically, we maintain a bullish stance, albeit cautiously, relying on the stability of oil prices above the …

Read More »Gold continues to record new historical peaks 7/3/2024

Gold prices have continued their remarkable ascent, defying our earlier anticipation of a bearish trend. In our previous report, we emphasized the significance of trading below the historical resistance level of 2144. However, with the price surging beyond this historical peak, reaching $2161 per ounce at the opening of today’s …

Read More »CAD gradually rising 6/3/2024

Quiet positive trading characterized the movements of the Canadian dollar yesterday, aligning with the anticipated bullish trend and nearing the first target of 1.2610, reaching a peak of 1.2605. In terms of technical analysis today, we maintain a cautiously optimistic stance, contingent upon trading stability above the established support level …

Read More »Oil reaches the desired target 6/3/2024

US crude oil futures prices experienced a significant decline, relinquishing earlier gains and confirming the bearish outlook outlined in yesterday’s analysis. The prices touched the initial target of $77.70, reaching a low of $77.55 per barrel. Upon closer examination of the 4-hour chart, it is evident that the price remains …

Read More »Gold hits resistance and loses momentum 6/3/2024

Gold prices experienced significant gains during the previous trading session, in line with the anticipated positive trend, nearing the historical peak recorded around $2144 per ounce and reaching a high of $2141. Analyzing the technical aspects today, particularly on the 4-hour timeframe, we observe that the resistance level at $2144, …

Read More »CAD building on support 5/3/2024

The Canadian Dollar pair has made modest upward attempts, finding support around the 1.3510 level and reaching its peak at 1.3585 during the previous trading session. In terms of technical analysis today, we cautiously lean towards a positive outlook, contingent upon the pair maintaining stability above the mentioned support level …

Read More »Oil is experiencing temporary negative pressure 5/3/2024

The previous trading session saw mixed activity in US crude oil futures contracts, with prices touching the official target at $80.40 per barrel before retracing slightly. Technically, the resistance level at $80.40 exerted downward pressure on oil prices, prompting a temporary retreat. Currently, prices are hovering near the lower end …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations