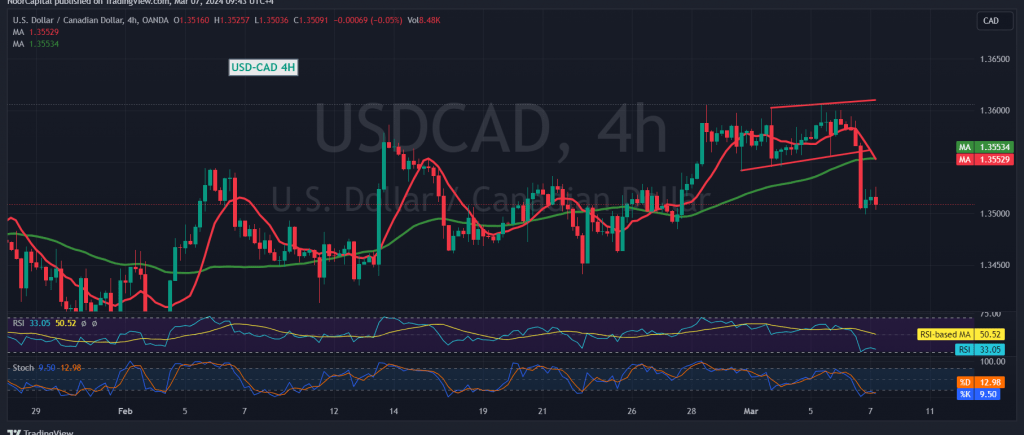

The Canadian dollar pair encountered significant resistance at the psychological barrier level, failing to breach it and subsequently experiencing negative pressure, leading to a downward movement to retest 1.3500.

Today’s technical analysis suggests a bearish outlook, with emphasis on the intraday stability below the 1.3570 resistance level. Additionally, negative indications on the 14-day momentum indicator, coupled with its stability below the 50 midline, further support the bearish sentiment.

As such, the preferred direction in the upcoming hours is downward, with a potential breakthrough of 1.3500 paving the way for a visit to 1.3470 and 1.3430, respectively.

However, should the price consolidate above 1.3570, with the closing of at least an hour candle, this would delay the downside potential and lead to an upward bias, initially targeting a retest of 1.3600.

It’s important to exercise caution today as we await high-impact economic data releases from both the Eurozone and the United States. This includes the Eurozone’s interest rate and monetary policy statement from the European Central Bank, as well as the press conference by the ECB. Additionally, we anticipate the testimony of the Chairman of the Federal Reserve from the United States, which may induce significant price fluctuations upon release.

Given the potential for increased volatility, traders should remain vigilant and consider the impact of these economic events on their trading decisions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations