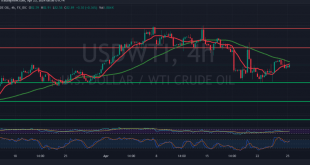

US crude oil futures prices experienced downward pressure at the beginning of the trading week, encountering resistance near the psychological threshold of $84.00. From a technical perspective, a bearish outlook emerges, driven by the resurgence of simple moving averages exerting downward pressure, coupled with the price’s positioning below key sub-resistance …

Read More »Gold may resume the downward correction 30/4/2024

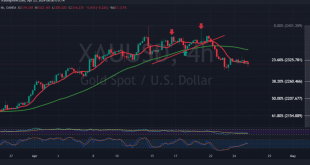

Gold prices recently found robust support at $2325, a level crucial for maintaining the short-term upward trend. This support prompted a modest rebound, with prices reaching a peak of $2346 per ounce. Analyzing the 240-minute time frame chart reveals a return to stability below the 50-day simple moving average, reinforcing …

Read More »Euro is looking for a stronger direction 30/4/2024

The EUR/USD pair continues to experience mixed movements, oscillating within a narrow sideways range. This range is bounded by the 1.0730 resistance level on the upper end and the 1.0680 support level on the lower end. A detailed examination of the 4-hour time frame chart reveals that the pair’s intraday …

Read More »Dow Jones facing negative pressure 25/4/2024

Oil, Crude, trading

Read More »CAD: negative pressure exists 25/4/2024

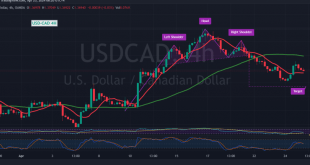

The Canadian dollar has continued its bearish trajectory, encountering strong resistance near the 1.3730 level, prompting renewed negative trading for the pair. From a technical standpoint, the 240-minute timeframe reveals the persistence of bearish technical patterns, reinforcing the overarching daily downtrend. Additionally, the ongoing formation of simple moving averages continues …

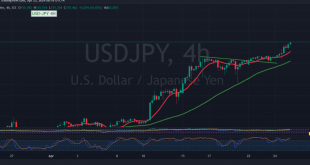

Read More »USD/JPY achieve the goals and positivity persists 25/4/2024

japanese-yen

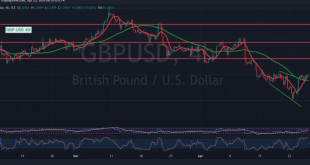

Read More »GBP stable above support 25/4/2024

Oil, Crude, trading

Read More »Oil losing bullish momentum 25/4/2024

In the latest technical analysis, we maintained a neutral stance due to conflicting signals in the market. However, the continuation of a downward trend hinges on US crude oil futures prices remaining below the pivotal resistance level of $83.90, which saw a peak at $83.67 per barrel. Examining the 4-hour …

Read More »Gold maintains the downward path 25/4/2024

The rise in gold prices that began during the previous trading session stopped when the price collided with the 2335 resistance level, forcing it to trade within the negative range. From the angle of technical analysis today, by looking at the 240-minute time frame chart, we find the price stable …

Read More »Euro stable below resistance 25/4/2024

In the latest update, the EUR/USD pair encountered resistance at the previously mentioned level of 1.0715, hindering its upward momentum. Currently, the pair is hovering around the psychological barrier of 1.0700. Analyzing the technical indicators, the upward trend remains constrained, with the Stochastic indicator signaling negativity. Furthermore, the pair continues …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations