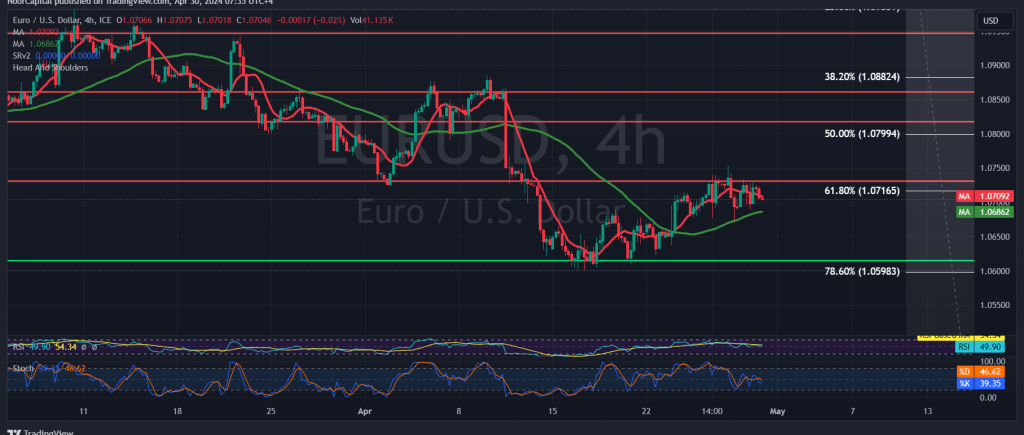

The EUR/USD pair continues to experience mixed movements, oscillating within a narrow sideways range. This range is bounded by the 1.0730 resistance level on the upper end and the 1.0680 support level on the lower end.

A detailed examination of the 4-hour time frame chart reveals that the pair’s intraday movements are currently characterized by stability below the 1.0715 resistance, corresponding to the 61.80% Fibonacci retracement. Additionally, negative signals on the momentum indicator are evident, accentuated by the downward trend indicated by the 14-day momentum indicator.

Given the sustained intraday trading below the 1.0715 resistance level, particularly in proximity to the 61.80% Fibonacci retracement, and more broadly below 1.0735, the possibility of further decline looms. A breach below 1.0660 could pave the way for a descent towards 1.0620, potentially extending losses to 1.0570 thereafter.

However, a decisive upward breach and consolidation above the aforementioned resistance at 1.0735 would defer the anticipated bearish scenario. This could prompt a temporary recovery, with targets set for retesting resistance levels at 1.0770 and 1.0795, representing the 50.0% Fibonacci correction.

It’s important to note the potential influence of the 50-day simple moving average, which may offer a positive stimulus to market sentiment.

Furthermore, today’s trading session is marked by the release of high-impact economic data from the American economy, including the “Employment Cost Index” and “Consumer Confidence Index.” Traders should be prepared for heightened price volatility surrounding the news releases.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations