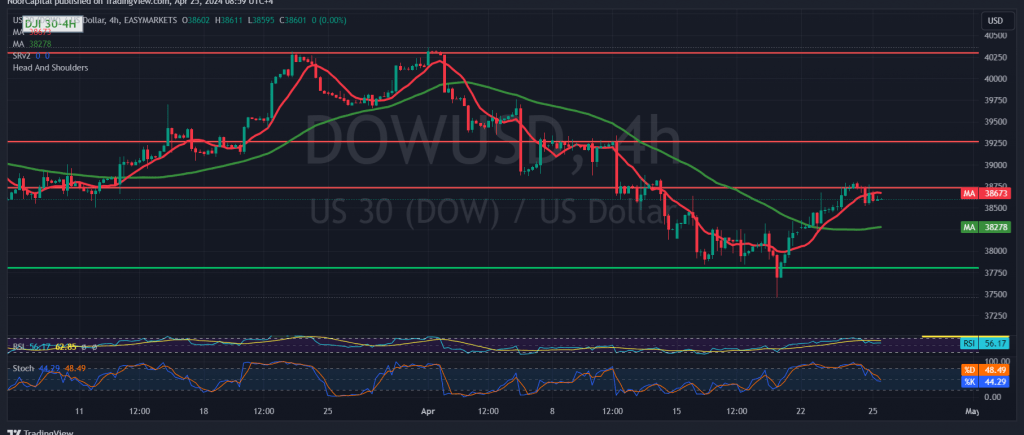

The Dow Jones Industrial Average on Wall Street experienced a downturn, primarily attributed to encountering a robust resistance barrier near the 38800 mark.

From a technical perspective today, there’s a leaning towards negativity in trading sentiment, underpinned by clear negative signals on the Relative Strength Index, which remains below the 50 midline. Additionally, there’s a temporary loss of momentum indicated by the Stochastic indicator.

With trading persisting below the resistance level of 38765, the potential for a bearish trend looms in the coming hours. This would be further confirmed by a decisive breach of the support level at 38560, which could pave the way for a downward trajectory towards 38500 and 38485, respectively.

Conversely, a return to daily trading stability above 38765 would halt the downward momentum, potentially signaling a return to the official upward trajectory with targets set at 38925 and 39040.

Given the release of high-impact economic data from the American economy today, including the Estimated GDP reading, pending home sales, and unemployment benefits, heightened price fluctuations are anticipated during these periods.

Acknowledging the elevated risks associated with market movements, particularly amidst ongoing geopolitical tensions, which could result in increased volatility, is essential.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations