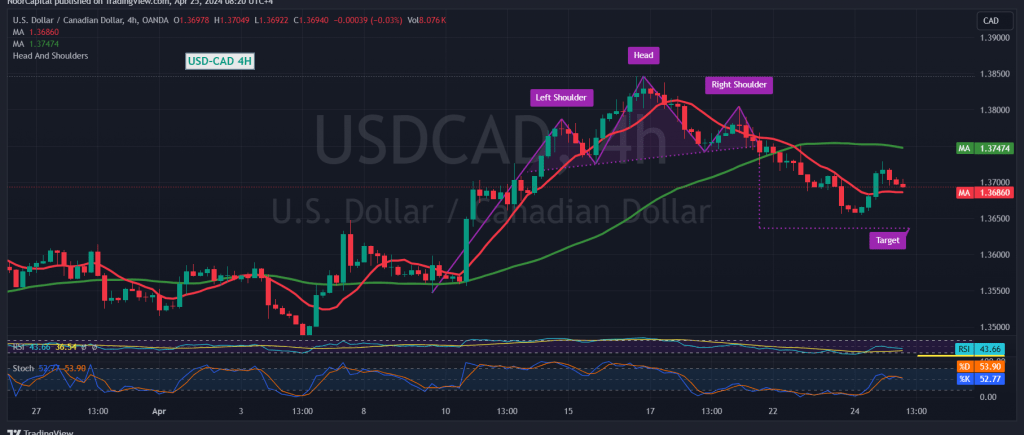

The Canadian dollar has continued its bearish trajectory, encountering strong resistance near the 1.3730 level, prompting renewed negative trading for the pair.

From a technical standpoint, the 240-minute timeframe reveals the persistence of bearish technical patterns, reinforcing the overarching daily downtrend. Additionally, the ongoing formation of simple moving averages continues to exert downward pressure.

As such, the prevailing outlook suggests further downside movement during today’s session, with targets set at 1.3660 as the initial objective, followed by 1.3610, which represents a significant awaited station. Subsequent targets may extend downwards to 1.3580.

It’s important to note that a return to trading stability above 1.3730 has the potential to invalidate the bearish scenario, leading to a potential recovery for the pair. In this scenario, the initial target lies around 1.3740, with potential gains extending towards 1.3800.

Given the release of high-impact economic data from the American economy today, including the Estimated GDP reading, pending home sales, and unemployment benefits, traders should anticipate heightened price fluctuations during these periods.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations