The dollar/yen pair experienced a significant decline in the previous session, aligning with the anticipated negative outlook outlined in the previous technical report. The pair reached the officially targeted level at 147.10, marking its lowest point at 146.98.

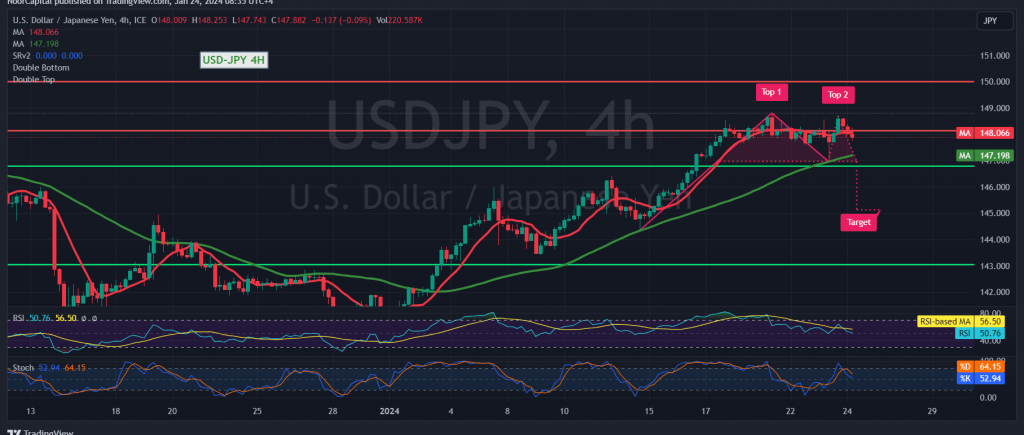

From a technical perspective today, the bias continues to be negative, relying on the stability of trading below the pivotal resistance situated at 148.60. Additionally, clear signals of a negative crossover are observed on the Stochastic indicator on the 4-hour time frame.

Consequently, the bearish outlook remains the most likely scenario for the day. A breach below 147.00 would extend the pair’s losses, opening the way directly toward the awaited official level at 146.15.

Conversely, an upward cross and rise beyond 148.60 would nullify the activation of the expected bearish tendency, prompting an immediate recovery for the pair towards 149.00 and 149.50, respectively.

Investors should exercise caution today as high-impact economic data is anticipated from the American, French, and German economies, including preliminary readings of the services and manufacturing PMI indices. Additionally, the preliminary reading of the services and manufacturing PMI index from Britain and the Canadian interest rate decision, along with the Bank of Canada press conference, may contribute to heightened volatility in the market.

Cautionary Notes:

- Risk Level: High

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations