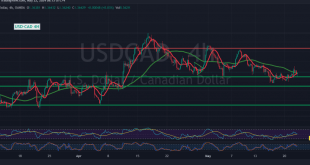

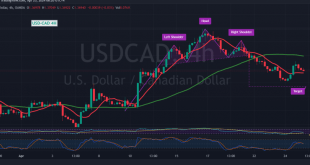

Limited positive trading dominated the Canadian dollar’s movements during the previous session, failing to breach the 1.3675 resistance level and resulting in a negative bias. Technical Analysis Examining the 4-hour chart reveals the following: Stochastic Indicator: Continues to provide negative signals.50-Day Simple Moving Average: Trading stability below this level supports …

Read More »Oil: facing negative pressure 22/5/2024

US crude oil futures experienced a downward trend in the previous session, encountering resistance at $79.60 per barrel, leading to significant declines and reaching a low of $77.67. Technical Analysis Our outlook remains bearish, based on the following technical factors: Resistance Levels: Intraday trading remains below the key psychological resistance …

Read More »Gold: Bearish Correction Amid Market Volatility 22/5/2024

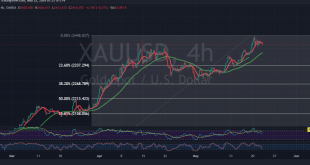

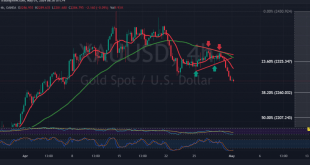

In the previous trading session, gold prices exhibited a bearish tendency, stabilizing below the main resistance level at $2430 per ounce and reaching a low of $2406. Technical Analysis Examining the 4-hour chart reveals the following: Resistance Levels: Price remains stable below the $2430 resistance.Stochastic Indicator: Showing a gradual loss …

Read More »CAD making notable gains 1/5/2024

Positive momentum continued to drive the movements of the Canadian dollar, aligning with the anticipated upward trajectory outlined in the previous technical report. The currency successfully reached the official targets at 1.3750 and 1.3790, achieving its peak during the morning trading session at 1.3783. Today’s technical analysis leans towards positivity, …

Read More »Oil is under selling pressure 1/5/2024

The downward trend persisted in US crude oil futures contracts, as anticipated, surpassing yesterday’s official target of $81.50 and hitting a low of $80.97 per barrel. Technically, on the 4-hour chart, the simple moving averages continue to exert downward pressure on the price, accompanied by negative signals from the relative …

Read More »Gold suffers huge losses and all eyes are on Fed 1/5/2024

Gold prices experienced significant losses during yesterday’s trading session, in line with our previous technical analysis, reaching the official targets set at $2290 per ounce. The lowest point was recorded at $2281 per ounce during early trading. Today’s technical outlook suggests a potential continuation of the downward correction, with trading …

Read More »CAD needs more determination to continue rising 30/4/2024

The Canadian dollar experienced an upward trend, finding support at 1.3630, which facilitated a rebound, with the pair currently stabilizing near its morning peak around 1.3680. Today’s technical analysis suggests a positive outlook, buoyed by the supportive influence of the 50-day simple moving average. This is further reinforced by favorable …

Read More »Oil: negative pressure remains 30/4/2024

US crude oil futures prices experienced downward pressure at the beginning of the trading week, encountering resistance near the psychological threshold of $84.00. From a technical perspective, a bearish outlook emerges, driven by the resurgence of simple moving averages exerting downward pressure, coupled with the price’s positioning below key sub-resistance …

Read More »Gold may resume the downward correction 30/4/2024

Gold prices recently found robust support at $2325, a level crucial for maintaining the short-term upward trend. This support prompted a modest rebound, with prices reaching a peak of $2346 per ounce. Analyzing the 240-minute time frame chart reveals a return to stability below the 50-day simple moving average, reinforcing …

Read More »CAD: negative pressure exists 25/4/2024

The Canadian dollar has continued its bearish trajectory, encountering strong resistance near the 1.3730 level, prompting renewed negative trading for the pair. From a technical standpoint, the 240-minute timeframe reveals the persistence of bearish technical patterns, reinforcing the overarching daily downtrend. Additionally, the ongoing formation of simple moving averages continues …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations