As investors continued to process the most recent FOMC meeting and the prospect of three rate reduction by the Fed this year, risk aversion made a comeback on Thursday across markets and traded assets, giving the dollar additional impetus. Apart from that, the BoE maintained rates and hinted at potential …

Read More »Gold is waiting for a movement signal 19/3/2024

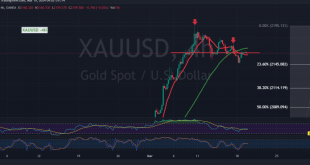

Gold prices experienced mixed trading during the first trading session of the week, testing the main support level around 2145 and maintaining positive stability above it. From a technical perspective, examining the 4-hour time frame chart reveals that gold remains stable above the previously breached resistance, now acting as a …

Read More »Market Drivers – US Session, March 18

The US Dollar kicked off the week on a strong note, fueled by rising US Treasury yields and diminishing expectations of an interest rate cut by the Federal Reserve in June. This greenback surge weighed on riskier assets, pushing the Euro (EUR/USD) below 1.0900, a multi-day low.The Dollar Index (DXY) …

Read More »Weekly Recap: Surprising US Data Strengthens Case for Delaying Interest Rate Cuts

Last week, the market’s attention was squarely fixed on a slew of US economic indicators, aimed at deciphering clues regarding future interest rate trajectories and the Federal Reserve’s timeline for ending its monetary tightening stance and initiating quantitative easing. However, the latest US data, particularly the Consumer Price Index, US …

Read More »Gold maintains positive stability 15/3/2024

For the second session in a row, levels of 2157 were able to limit the downward trend witnessed by gold prices, maintaining positive stability, and at the time of the report, it was trading around $2165 per ounce. From the angle of technical analysis today, by looking at the 4-hour …

Read More »Gold resumes its rise 14/3/2024

Gold prices have rebounded, resuming their official upward trajectory and negating the need for the retesting scenario outlined in the previous technical report. The metal settled with its lowest level recorded at $2157 per ounce. Today’s technical analysis, focusing on the 4-hour timeframe chart, indicates continued support from the simple …

Read More »Gold retesting the main support 13/3/2024

In the previous trading session, negative sentiment dominated the price movements of gold following the release of US inflation data, which bolstered the dollar’s performance at the expense of gold’s attractiveness. Today’s technical analysis reveals that the 2184 resistance level is exerting downward pressure on the price, while a closer …

Read More »Gold Prices Retreat from Record Highs Ahead of Key U.S. Inflation Data

Traders Take Profits Amid Anticipation of Interest Rate Factors Gold prices experienced a decline in Asian trade on Tuesday, stepping back from recent record highs as traders locked in profits ahead of the release of key U.S. inflation data. The anticipated CPI figures are expected to significantly influence the trajectory …

Read More »Gold continues to maintain its gains 12/3/2024

Gold prices have sustained their impressive rally into the second consecutive week, reaching a pinnacle during the initial trading sessions of this week at $2,189 per ounce, marking a new record high. Today’s technical analysis, focusing on the 4-hour timeframe chart, reveals that the simple moving averages remain supportive of …

Read More »Market Drivers – US Session, March 11

In the commodity market, WTI crude oil prices maintained their consolidative stance in the commodities market, circling the pivotal 200-day SMA and attempting to break through the $78.00 region. At $77.77 per barrel, US crude oil was last observed up 0.53%. Tuesday’s weekly update on US crude oil stocks as …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations