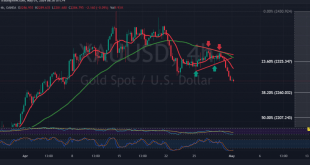

Gold prices experienced significant losses yesterday, aligning with the downward corrective trend identified in the previous technical report. The price reached the forecasted target of $2375, recording its lowest level at $2366 per ounce. Examining the 4-hour time frame chart, several key technical indicators suggest the continuation of a downward …

Read More »Gold: Bearish Correction Amid Market Volatility 22/5/2024

In the previous trading session, gold prices exhibited a bearish tendency, stabilizing below the main resistance level at $2430 per ounce and reaching a low of $2406. Technical Analysis Examining the 4-hour chart reveals the following: Resistance Levels: Price remains stable below the $2430 resistance.Stochastic Indicator: Showing a gradual loss …

Read More »Financial Markets Recap: Mixed Signals and Market Volatility Shape Investor Sentiment

The U.S. Last week, the U.S. stock market continued its upward trajectory, inching closer to record highs amid light trading volumes. The S&P 500 Index notched its third consecutive week of gains, nearing its all-time peak. While the broader market advanced, the spotlight was on value stocks, which outpaced growth …

Read More »Gold advances, ignores stronger US Dollar following soft US data

Gold advances on weaker than expected US data despite strong US Dollar Gold rebounds from daily lows, with the assistance of a significant push by a sharp drop in US consumer sentiment and future economic outlook. High US Treasury yields weren’t an excuse for Gold’s advance. US consumers expect inflation …

Read More »Market Drivers; US Session, May 9

The USD Index (DXY) gave up some of its recent gain amid lower yields across the curve due to a data-driven sell-off. The BoE furthered the policy divide between the Fed and its G10 counterparts by holding rates steady and paving the way for a rate cut earlier than expected. …

Read More »Market Drivers; US Session, May 7

With the global markets in the midst of a generalised consolidation phase, the US dollar saw some decent gains as the FX universe gradually turned its focus to the announcement of the US CPI next week. In the face of further declines in US rates, the USD Index, or DXY, …

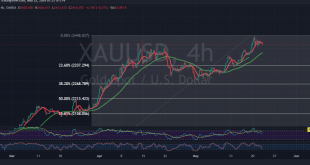

Read More »What is behind Gold’s Ascending Uptrend: Key Factors, Market Insights

Gold prices have recently surged to historical levels, mainly capitalizing on several factors that have come to the forefront, including its prestigious status as a trusted safe haven. In this article, we’ll delve into these elements and explore their impact on the precious metal’s bullish trajectory.The Federal Reserve’s decisions, including …

Read More »Weekly Recap: Dollar Weakness Yields to Gold and Risk Asset Gains

US Dollar Index (DXY) Slips on Weak Employment Data Significant losses were incurred by the US Dollar Index (DXY), closing the North American session on Friday around the 105 mark, in contrast to the week’s opening reading of 106.093. This decline followed the release of US employment data for April, …

Read More »Gold stabilized below $2,300 ahead of Fed decision

Earlier on Wednesday, the XAU/USD Index was trading with gains of 0.84% at $2,304 amid falling US Treasury yields and a weak US Dollar. At the time of writing, it trading at $2299.20 per ounce.Manufacturing activity expanded in April, according to S&P Global. However, the Institute for Supply Management (ISM) …

Read More »Gold suffers huge losses and all eyes are on Fed 1/5/2024

Gold prices experienced significant losses during yesterday’s trading session, in line with our previous technical analysis, reaching the official targets set at $2290 per ounce. The lowest point was recorded at $2281 per ounce during early trading. Today’s technical outlook suggests a potential continuation of the downward correction, with trading …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations