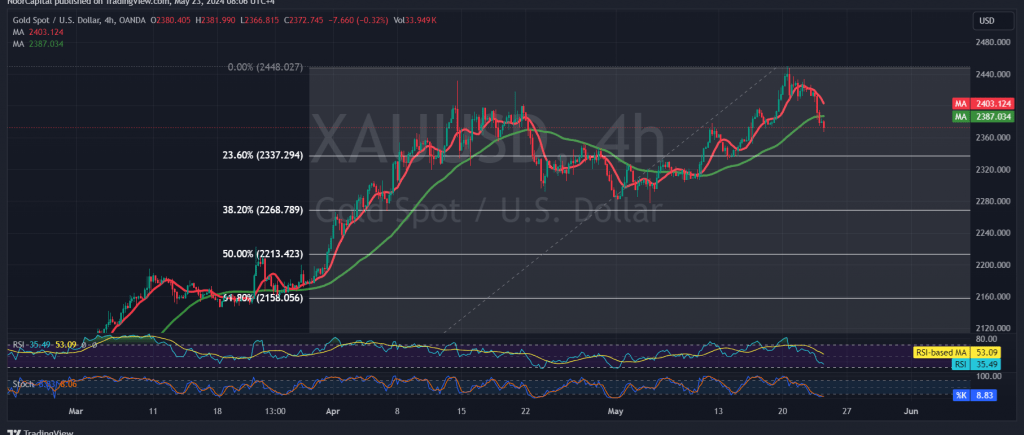

Gold prices experienced significant losses yesterday, aligning with the downward corrective trend identified in the previous technical report. The price reached the forecasted target of $2375, recording its lowest level at $2366 per ounce.

Examining the 4-hour time frame chart, several key technical indicators suggest the continuation of a downward trend:

- Simple Moving Averages (SMA): The SMAs are exerting negative pressure on gold prices from above, indicating a bearish market sentiment.

- Momentum Indicator: The 14-day momentum indicator remains below the midline of 50, reinforcing the bearish outlook.

Given these indicators, the possibility of continued corrective decline is high. The next targets are set at:

- 2349: The immediate support level.

- 2337: Corresponding to the 23.60% Fibonacci retracement level.

Upside Potential: For the bearish scenario to be invalidated, gold prices need to break above:

- 2395: A key resistance level.

- 2400: A critical psychological threshold. Should these levels be surpassed and sustained, gold prices may resume an upward trajectory towards:

- 2410

- 2430

Economic Data and Market Volatility: Today’s market may experience high volatility due to the release of significant economic data from major economies, including:

- France and Germany: Preliminary readings of the Services and Manufacturing PMI indices.

- United Kingdom: Preliminary reading of the Services and Manufacturing PMI indices.

- United States: Preliminary reading of the Services and Manufacturing PMI indices.

Geopolitical Risks: High geopolitical tensions continue to pose a significant risk, potentially leading to substantial price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations