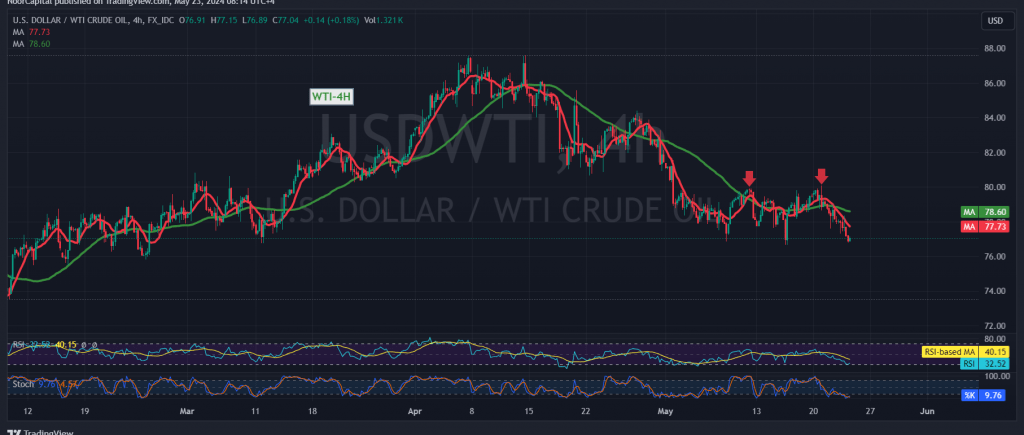

US crude oil futures experienced a significant decline yesterday, aligning with the negative outlook projected in the previous technical report. The prices hit the target levels of $77.40 and $76.75, recording a low of $76.85 per barrel.

The bearish trend remains the dominant scenario for today’s trading session, supported by several technical indicators:

- Role Reversal: The previously broken support level at $77.70 has turned into a resistance level, adhering to the concept of role reversal.

- Simple Moving Averages (SMA): The SMAs are exerting downward pressure on prices, indicating continued bearish momentum.

Given these factors, the downward trend is likely to continue, with the following targets:

- 76.50: The immediate support and first official target.

- 75.90: Breaking below 76.50 paves the way for this level.

- 75.30: Potential further losses beyond 75.90.

Upside Potential: Should prices consolidate above $77.70, the bearish scenario would be invalidated, and oil prices could recover, targeting:

- 78.90: The initial recovery target.

Economic Data and Market Volatility: Today’s market may experience heightened volatility due to the release of significant economic data from major economies, including:

- France and Germany: Preliminary readings of the Services and Manufacturing PMI indices.

- United Kingdom: Preliminary reading of the Services and Manufacturing PMI indices.

- United States: Preliminary reading of the Services and Manufacturing PMI indices.

Geopolitical Risks: Ongoing geopolitical tensions continue to pose a significant risk, potentially leading to substantial price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations