japanese-yen

Read More »GBP fails to break through the resistance 28/2/2024

Oil, Crude, trading

Read More »Oil breaks resistance 28/2/2024

In yesterday’s technical report, we maintained a neutral stance due to conflicting technical signals, noting that consolidation of the price above $78.00 could pave the way for reaching $78.35 as the first target, with potential further gains extending to $79.20. American crude oil prices managed to peak at $78.95 per …

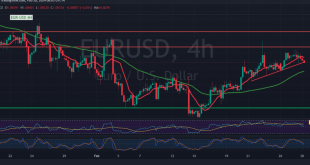

Read More »Euro waiting for a signal 28/2/2024

The EUR/USD pair continues to experience narrow sideways trading for the third consecutive session, maintaining a range between the main support level of 1.0765 and the pivotal resistance of 1.0860. From a technical perspective today, upon analysis of the 4-hour timeframe chart, the 50-day simple moving average persists in guiding …

Read More »Nasdaq stable above support 27/2/2024

Oil, Crude, trading

Read More »Dow Jones trying to record additional gains 27/2/2024

Oil, Crude, trading

Read More »CAD presses support 27/2/2024

The Canadian dollar experienced tranquil trading conditions with a slight positive bias, manifesting a sideways trend confined between the lower boundary around 1.3500 and the upper threshold below 1.3535. Today’s technical analysis, upon scrutiny of the 4-hour timeframe chart, reveals the simple moving average endeavoring to uplift the price. However, …

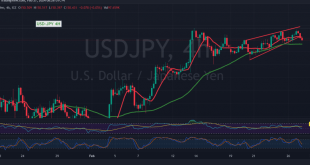

Read More »USD/JPY facing negative pressure 27/2/2024

japanese-yen

Read More »GBP attacks the resistance 27/2/2024

Oil, Crude, trading

Read More »Oil is looking for a new movement signal 27/2/2024

At the onset of this week’s trading, US crude oil futures contracts experienced a modest uptick, marking their peak yesterday in close proximity to the psychological resistance threshold of 78.00. From a technical standpoint, a scrutiny of the 4-hour timeframe chart reveals the resurgence of the 50-day simple moving average, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations