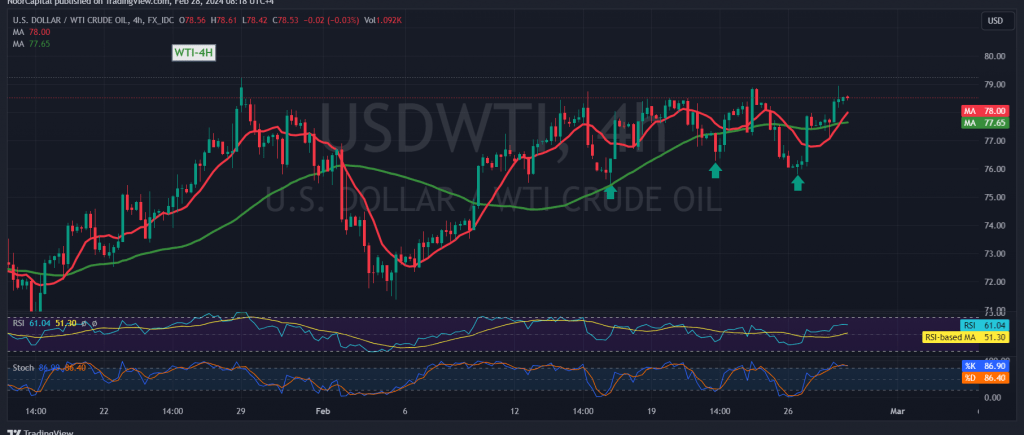

In yesterday’s technical report, we maintained a neutral stance due to conflicting technical signals, noting that consolidation of the price above $78.00 could pave the way for reaching $78.35 as the first target, with potential further gains extending to $79.20. American crude oil prices managed to peak at $78.95 per barrel.

From a technical perspective, we are inclining towards positivity, buoyed by the encouraging momentum provided by the simple moving averages, which have resumed carrying the price from below. Additionally, the successful upward crossover and consolidation above the psychological resistance level of $78.00 further reinforce this sentiment.

Consequently, there exists a possibility of a resurgence in the upward trend, with an initial target set at $79.25. A breakthrough at this level would not only strengthen but also accelerate the upward momentum, potentially opening the path towards the awaited official station at $80.00.

Conversely, a breach below $77.55 would invalidate the activation of the proposed scenario, triggering a bearish tendency in oil prices with a target set at $76.50 before any potential upward movement resumes.

A cautionary note: Today’s trading landscape is influenced by the impending release of high-impact economic data from the American economy, particularly the preliminary reading of the gross domestic product – quarterly. Consequently, heightened volatility is anticipated at the time of the news release.

Moreover, it is crucial to acknowledge the elevated risk environment amidst ongoing geopolitical tensions, which may contribute to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations