Oil, Crude, trading

Read More »Dow Jones achieves the desired goals 29/2/2024

Oil, Crude, trading

Read More »CAD retests support 29/2/2024

The Canadian dollar performed in line with our expectations during the previous trading session, achieving the first target at $1.3590 and reaching a peak of $1.3606. In today’s technical analysis, observing the 4-hour timeframe chart, we note that the pair’s intraday movements are currently stabilized below the psychological barrier resistance …

Read More »USD/JPY turns bearish 29/2/2024

japanese-yen

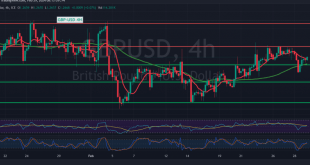

Read More »GBP looking for additional momentum 29/2/2024

Oil, Crude, trading

Read More »Oil gets a positive close 29/2/2024

The recent trading sessions for US crude oil futures contracts showcased a positive trend, aligning with the anticipated bullish context and achieving the initial target set forth in the previous report at $79.25, with a peak at $79.60 per barrel. In today’s technical analysis, we maintain a positive outlook, albeit …

Read More »Euro trying to recover 29/2/2024

In the previous technical report, we maintained an intraday neutral stance due to conflicting technical signals, highlighting the significance of breaching the psychological barrier support at 1.0800 as the initiation of a downward trend in the immediate term. Today’s technical analysis reveals that the EUR/USD pair has managed to stabilize …

Read More »Nasdaq touches the first target 28/2/2024

Oil, Crude, trading

Read More »Dow Jones facing negative pressure 28/2/2024

Oil, Crude, trading

Read More »CAD gets a positive signal 28/2/2024

During the previous session’s trading, the Canadian dollar saw a resurgence of upward momentum, leveraging the support level at 1.3480 to initiate an upward rebound, with current levels hovering around 1.3540. Today’s technical analysis suggests a positive outlook, primarily driven by the reestablishment of stability in the pair’s price above …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations