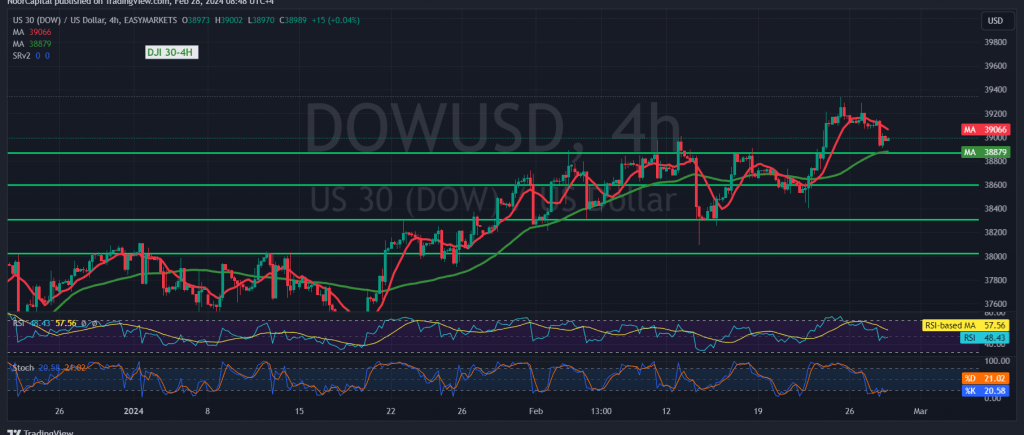

Yesterday, the Dow Jones Industrial Average experienced a negative trading session on the Wall Street Stock Exchange, which contradicted the previously anticipated positive outlook. In the previous report, we had emphasized the importance of maintaining stability above 39,010, highlighting that a breach below this level would signal a shift to strong negative pressure, targeting 38,930. Indeed, the index recorded its lowest level at 38,911 before rebounding.

Today’s technical analysis reveals negative signals from the Stochastic indicator, coupled with the Momentum indicator for the 14-day period stabilizing below the 50 midline.

Despite these negative indicators, a confirmed downward trend hinges on breaking below 38,910, with an initial target set at 38,880. Should this level be breached, further losses could extend towards 38,775.

Conversely, breaching above 39,125 would signify a return to the official upward trajectory for the index, with initial targets set at 39,260 and 39,370, respectively.

A word of caution: Today’s trading activity is influenced by the impending release of high-impact economic data from the American economy, specifically the preliminary reading of the gross domestic product – quarterly. Consequently, heightened volatility is anticipated at the time of the news release.

Moreover, it is crucial to acknowledge the elevated risk environment amidst ongoing geopolitical tensions, which may contribute to increased price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations