During the previous trading session, the Euro/Dollar pair witnessed predominantly positive trades, aligning with the anticipated bullish trajectory towards the official target of 1.0860. The pair reached its highest level at 1.0840, reflecting the strength of the upward movement. Technical Analysis Outlook From a technical standpoint today, examining the 4-hour …

Read More »CAD tries to break through the resistance 20/2/2024

The Canadian dollar displayed strength yesterday with an upward trend dominating its movements, carrying over into today’s trading session with a positive bias. The currency hovers around its morning peak, reaching 1.3510. Technical Analysis Points to Continued Positive Momentum Technical analysis indicates that the pair continues to benefit from support …

Read More »USD/JPY returns to the upward path 20/2/2024

japanese-yen

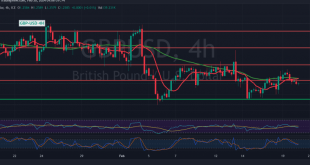

Read More »GBP stable below resistance 20/2/2024

Oil, Crude, trading

Read More »Oil maintains an upward trend 20/2/2024

US crude oil futures experienced quiet yet positive trading during yesterday’s US market holiday, reaching its highest level at $78.52 per barrel. Technical Analysis Reinforces Upward Trend The technical outlook for oil prices remains unchanged, with trading continuing within an upward trend observed within the ascending price channel depicted on …

Read More »Euro is trying to pass the resistance 20/2/2024

The EUR/USD pair experienced minimal fluctuations yesterday in the absence of US markets, as it made quiet attempts to achieve modest gains. Technical Analysis Highlights Euro’s Efforts to Break Resistance Today’s technical analysis reveals the euro’s endeavor to surpass the formidable resistance level situated at 1.0765, a crucial determinant of …

Read More »Weekly Financial Recap: US Data Dominates Market Sentiment

In the pulse of the financial world, the spotlight of the past week fell squarely on key US economic indicators, particularly inflation data, igniting a flurry of activity and recalibration across markets. Inflation Insights Headline US inflation for January came in at 3.1%, a modest improvement that fell slightly short …

Read More »CAD needs to break through the resistance 16/2/2024

Subdued Performance Recap:The Canadian dollar witnessed a notable decline in the previous trading session, reversing the anticipated upward trajectory outlined in the technical report. This downturn was primarily influenced by the weakening of the US dollar following the release of retail data. Technical Analysis Insights:Despite the recent bearish sentiment, the …

Read More »USD/JPY Looking for additional momentum 16/2/2024

japanese-yen

Read More »Oil building on support 16/2/2024

Support Holds Strong:The support level at 75.50, highlighted in the previous technical report, proved effective in halting the downward momentum of US crude oil futures prices. It is emphasized that the resumption of the downward trend hinges upon breaching this critical support level. Technical Analysis Insights:A closer examination of oil …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations