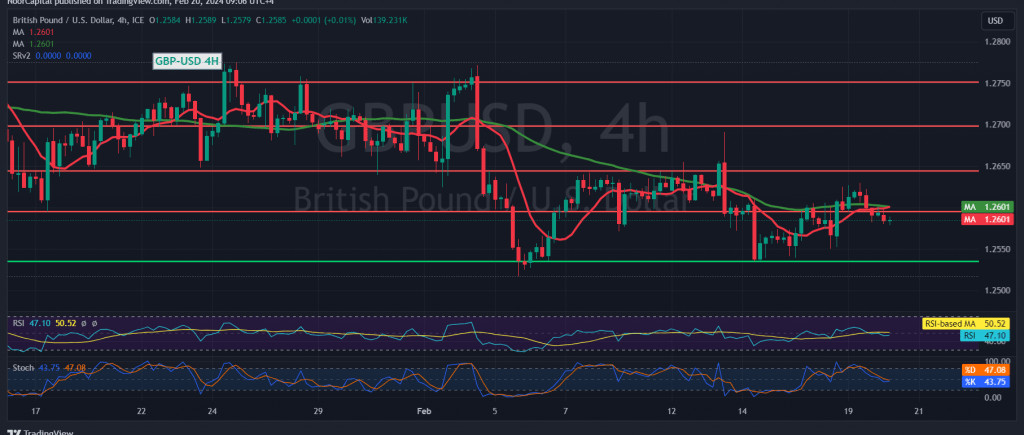

The movements of the pound sterling against the US dollar have been characterized by narrow-range side trading, with the currency pair confined between 1.2600 and 1.2650.

Technical Analysis Points Towards Bearish Bias

Today’s technical analysis suggests a bearish tilt in trading, primarily due to the pair’s inability to breach the pivotal resistance level at 1.2650. Furthermore, negative indications on the Stochastic indicator, coupled with a loss of upward momentum, reinforce this bearish sentiment.

Bearish Scenario Targets 1.2550 with Potential for Further Declines

In light of the technical outlook, the bearish scenario remains valid and effective, with an initial target set at 1.2550. A successful break below this level would strengthen and accelerate the downward trend, potentially opening the path towards 1.2500 before the next price destination is determined.

Activation of Bearish Scenario Hinges on Resistance Break

It’s important to note that activating the suggested bearish scenario requires stability below the formidable resistance at 1.2650. However, a complete breach of this level would nullify the bearish outlook, leading to a potential recovery towards 1.2680 and 1.2730.

Traders are advised to closely monitor the key resistance level at 1.2650, as it serves as a critical determinant of the pair’s trajectory. While a bearish bias persists, a breach of resistance could signal a shift in market sentiment towards a more bullish outlook. As such, proactive risk management strategies are essential for navigating potential fluctuations effectively.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations