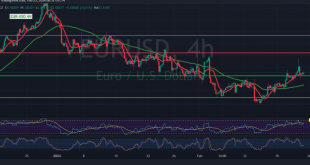

The EUR/USD pair has successfully reached the initial target outlined in our previous technical analysis, hitting 1.0860 and peaking at 1.0888. Upon examining the 4-hour chart, it’s evident that the level of 1.0860 is exerting downward pressure on the pair, prompting a potential retest of the psychological support barrier at …

Read More »CAD Struggles Against Psychological Barrier 22/2/2024

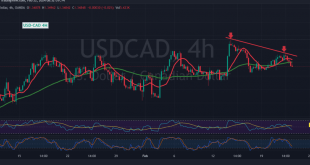

The Canadian dollar faces hurdles in maintaining stability above the psychological resistance level of 1.3500, which serves as a formidable obstacle, constraining bullish momentum. Technical Analysis Insights In the current market landscape, a bearish trend unfolds below the critical 1.3500 threshold. A detailed analysis of the 4-hour timeframe chart reveals …

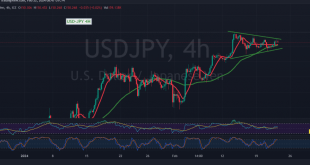

Read More »USD/JPY is waiting for a new signal 22/2/2024

japanese-yen

Read More »GBP Trying to Break Out of the Side Range 22/2/2024

Oil, Crude, trading

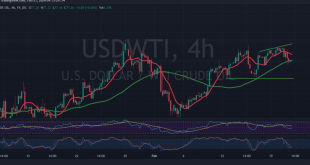

Read More »Oil Trying to Recover 22/2/2024

The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark. Technical Analysis …

Read More »Euro Continues Positive Momentum 22/2/2024

In the dynamic world of forex trading, the Euro/Dollar pair maintains its upward trajectory, demonstrating quiet yet positive trading sessions. During yesterday’s session, the pair reached its pinnacle at 1.0832, showcasing a bullish stance. Technical Analysis Insights Delving into the technical analysis realm today, a closer examination of the 4-hour …

Read More »CAD trying to gain additional momentum 21/2/2024

The Canadian dollar has exhibited the anticipated positive trajectory, achieving our initial target during the prior trading session, reaching a peak of 1.3529 against its counterpart. Technical Analysis Insights: Today’s technical analysis reveals the pair’s attempt to establish stability above the robust support level of 1.3500. Moreover, the Stochastic indicator …

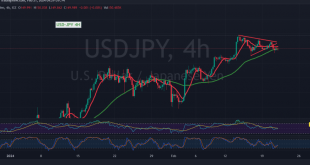

Read More »USD/JPY breaks support 21/2/2024

japanese-yen

Read More »GBP attacks the resistance 21/2/2024

Oil, Crude, trading

Read More »Oil prices to be monitored 21/2/2024

US crude oil futures experienced a notable rally in the previous trading session, nearing the first upward target mentioned in the previous technical report at $78.70. However, the price faced resistance and retreated, reaching a peak of $78.50 per barrel before encountering downward pressure. Technical Analysis Overview Examining the technical …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations