Japan’s Nikkei index managed to recover most of its early losses and closed relatively stable on Tuesday, March 3, as investors seized the opportunity to buy into declining stocks following a dip from record highs. The index dipped marginally by 0.03% to 40,097.63 points, significantly paring down its losses which …

Read More »Dow Jones is witnessing a downward trend 5/3/2024

Oil, Crude, trading

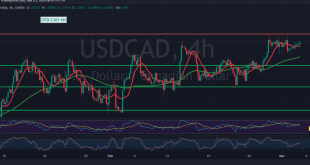

Read More »CAD building on support 5/3/2024

The Canadian Dollar pair has made modest upward attempts, finding support around the 1.3510 level and reaching its peak at 1.3585 during the previous trading session. In terms of technical analysis today, we cautiously lean towards a positive outlook, contingent upon the pair maintaining stability above the mentioned support level …

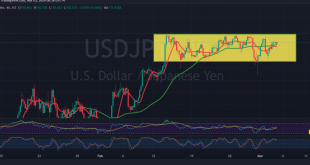

Read More »USD/JPY waiting for a signal 5/3/2024

japanese-yen

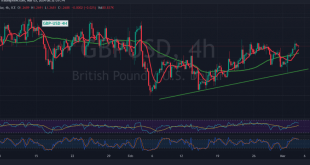

Read More »GBP trying positively 5/3/2024

Oil, Crude, trading

Read More »Oil is experiencing temporary negative pressure 5/3/2024

The previous trading session saw mixed activity in US crude oil futures contracts, with prices touching the official target at $80.40 per barrel before retracing slightly. Technically, the resistance level at $80.40 exerted downward pressure on oil prices, prompting a temporary retreat. Currently, prices are hovering near the lower end …

Read More »Gold is flirting with the historical peak 5/3/2024

Gold prices surged in the latest trading session, surpassing the targets outlined in technical reports from the previous week. The precious metal reached a peak of $2118 per ounce, marking a significant milestone in its upward trajectory. Analyzing the 4-hour chart through a technical lens reveals that the simple moving …

Read More »Euro looking for a stronger direction 5/3/2024

The EUR/USD pair has exhibited a slight upward bias during the initial trading sessions of the week. However, this upward momentum has been limited, with the pair struggling to consolidate above the key resistance level of 1.0860. On the technical front, analyzing the 4-hour time frame chart reveals that the …

Read More »Oil stabilizes after OPEC+ extends production cuts

Oil prices remained relatively steady on Monday following the decision by the OPEC+ alliance to extend voluntary production cuts until the end of the second quarter, in line with market expectations. Brent crude futures edged down by 14 cents to $83.41 per barrel by 1035 GMT, after experiencing a 2.4 …

Read More »European stocks are stable ahead of the European Central meeting

European stocks kicked off the week with little change as investors maintained caution ahead of the upcoming European Central Bank (ECB) monetary policy meeting later in the week. Although a rise in technology stocks partly offset losses in other sectors, the overall sentiment remained flat. The European STOXX 600 index …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations