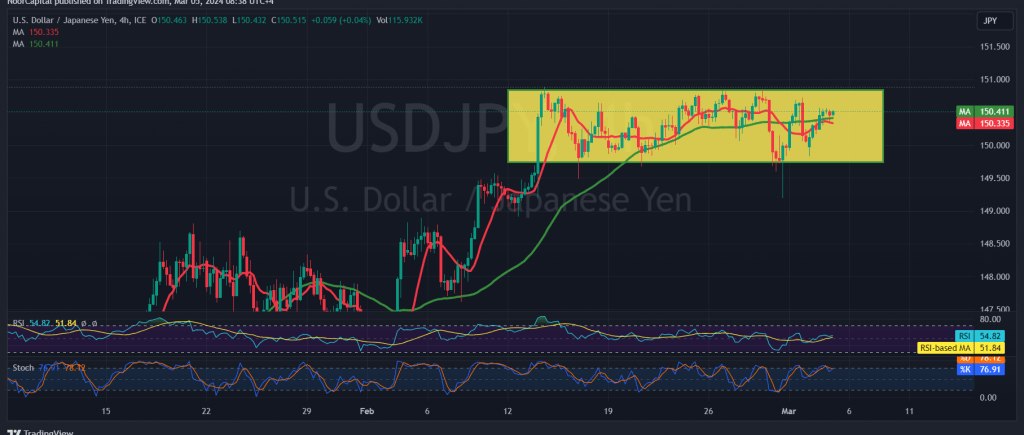

The USD/JPY pair continues to trade within a narrow range, with the price confined between 149.70 as support and 150.80 as a strong resistance level.

Examining the technical aspects on the 4-hour chart, the pair is attempting to stabilize above the 50-day simple moving average. However, the Stochastic indicator reflects ongoing negativity.

Given the range-bound trading and conflicting technical signals, it’s prudent to monitor the pair’s price behavior for potential scenarios:

- A clear and strong breach above the resistance level at 150.80 could signal an upward trend, potentially leading to further gains towards 151.25 and 151.70. Conversely, a break below 150.00, particularly 149.70, may initiate a downward movement with initial targets around 149.10.

Investors should exercise caution, especially with high-impact economic data expected from the American economy today, particularly the Services Purchasing Managers’ Index issued by the ISM. This release may contribute to increased volatility in the market.

In summary, while the USD/JPY pair remains range-bound, traders should closely monitor key support and resistance levels and adjust their strategies accordingly, considering the potential impact of upcoming economic data releases.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations