The primary Japanese stock index struggled to sustain its upward momentum on Tuesday, hovering approximately one percent below its highest peak recorded in over three decades. Trader apprehension ahead of Nvidia’s earnings release contributed to market uncertainty. China’s Interest Rate Cut Offers Brief Boost An unexpected interest rate cut in …

Read More »Dollar Strengthens, Stabilizing Above 150 Yen

On Tuesday, the dollar exhibited strength, maintaining its position above 150 yen amidst expectations of prolonged higher US interest rates. This occurred against the backdrop of Japan’s economic recession and market skepticism regarding Tokyo’s imminent monetary easing policy adjustment. China’s Mortgage Rate Cut Draws Trader Attention Early Tuesday, China’s decision …

Read More »Gold Prices Steady Despite Dollar and Bond Yield Rise

Gold prices maintained stability on Tuesday, resilient to a surge in the dollar and Treasury bond yields. Investors awaited insights from the Federal Reserve’s latest meeting minutes for potential clues regarding interest rate cuts. At 0341 GMT, the spot price of gold settled at $2,018.03 per ounce, with most US …

Read More »CAD tries to break through the resistance 20/2/2024

The Canadian dollar displayed strength yesterday with an upward trend dominating its movements, carrying over into today’s trading session with a positive bias. The currency hovers around its morning peak, reaching 1.3510. Technical Analysis Points to Continued Positive Momentum Technical analysis indicates that the pair continues to benefit from support …

Read More »USD/JPY returns to the upward path 20/2/2024

japanese-yen

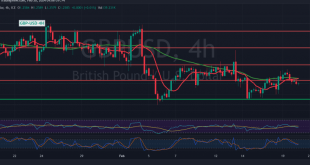

Read More »GBP stable below resistance 20/2/2024

Oil, Crude, trading

Read More »Oil maintains an upward trend 20/2/2024

US crude oil futures experienced quiet yet positive trading during yesterday’s US market holiday, reaching its highest level at $78.52 per barrel. Technical Analysis Reinforces Upward Trend The technical outlook for oil prices remains unchanged, with trading continuing within an upward trend observed within the ascending price channel depicted on …

Read More »Gold is struggling to settle above support 20/2/2024

Gold’s efforts to secure gains persist, albeit within constrained limits. The precious metal finds itself grappling with stabilization above the pivotal 2016 level, a critical determinant of medium-term trends, with prices reaching as high as $2023 per ounce. Technical Analysis Highlights Consolidation Efforts Today’s technical analysis, focusing on the 240-minute …

Read More »Euro is trying to pass the resistance 20/2/2024

The EUR/USD pair experienced minimal fluctuations yesterday in the absence of US markets, as it made quiet attempts to achieve modest gains. Technical Analysis Highlights Euro’s Efforts to Break Resistance Today’s technical analysis reveals the euro’s endeavor to surpass the formidable resistance level situated at 1.0765, a crucial determinant of …

Read More »Market Drivers – US Session, February 19

The ongoing Gaza crisis as well as fresh Houthi attacks are keeping barrel prices high. Monday saw a test of $78.11 a barrel for West Texas Intermediate crude, finding the opportunity to gain momentum as US markets were closed in observance of the federal holiday known as American President’s Day. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations