Mixed trading characterized the movements of US crude oil futures contracts in the previous session, attempting to recover from losses and reaching its peak at $76.77 per barrel.

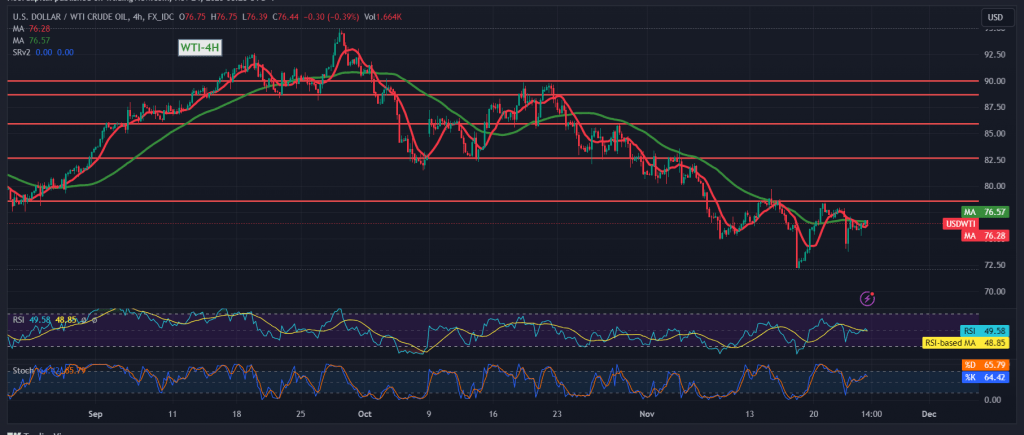

From a technical perspective, a closer examination of the 4-hour timeframe chart reveals that despite the efforts to rise, they appear to be limited. The price remains generally stable below the resistance level of 77.90, and it continues to trade below the 50-day simple moving average.

A cautious inclination towards negativity persists, targeting 75.75 as the initial objective. It is crucial to closely monitor the potential breach of this level, as it might pave the way for further concessions, with the path opening directly towards 74.75 and 74.10 as subsequent targets.

As a reminder, the consolidation of prices above 77.00 delays the likelihood of a decline. Conversely, an upward crossover and surpassing 77.90 could completely invalidate the bearish scenario. In such a case, oil prices would recover to visit 78.45, with gains extending towards 81.00.

Warning: The risk level may be high.

Warning: Today’s market activity will be influenced by impactful economic data from the Eurozone, the press talk by the President of the European Central Bank, and updates from the American economy. The release of the “preliminary reading of the services and manufacturing purchasing managers’ index” may induce high price fluctuations.

Warning: The overall risk level remains elevated due to ongoing geopolitical tensions, and heightened price volatility may be observed.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations