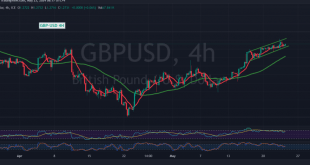

The British pound extended its losses against the US dollar within the negative outlook as we expected after it broke the strong support level 1.3800, touching the first target at 1.3740, recording the lowest price at 1.3726.

Technically, with the intraday trading continuing below 1.3790, and most importantly 1.3820, this encourages us to maintain our negative expectations, in addition to the clear negative signs on stochastic on the 240-minute time frame.

Therefore, the bearish scenario remains valid and effective, knowing that trading below 1.3720 will extend the pair’s losses to target 1.3690 and 1.3660, respectively.

The bearish scenario depends on the price stability below the previously broken support-into-resistance level, 1.3820.

Note: The RSI is trying to provide positive signals on the short time frames.

| S1: 1.3720 | R1: 1.3790 |

| S2: 1.3690 | R2: 1.3820 |

| S3: 1.3660 | R3: 1.3880 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations