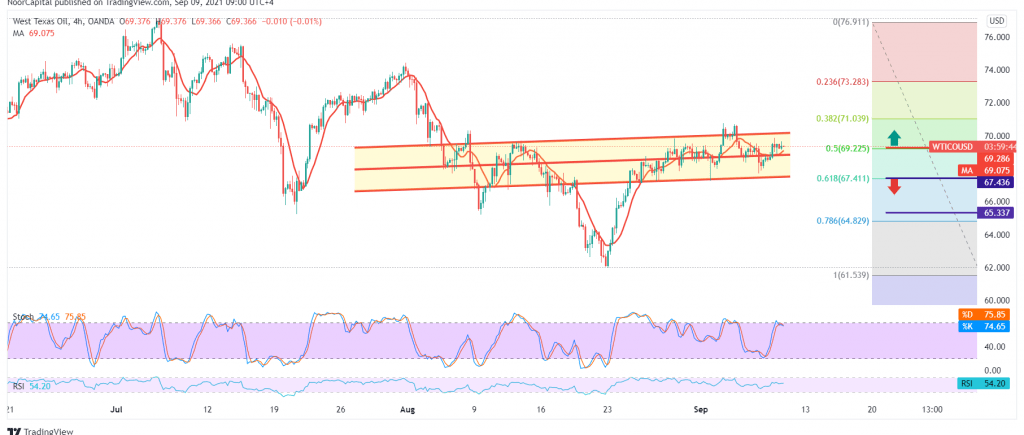

Mixed trading continues to dominate the movements of the US crude oil futures confined between 68.40 and 69.25.

Technically, and with careful consideration on the 4-hour chart, we find the 50-day moving average that supports the return of the bullish bias, accompanied by the RSI’s attempts to obtain bullish momentum. On the other hand, we find stochastic is approaching the overbought phase.

we preferred to stay on the fence waiting for one of the following scenarios:

The bullish trend requires price stability above 69.25 50.0% Fibonacci correction, which enhances the chances of rising to visit 69.80 and 70.45 respectively, knowing that the official target if oil succeeds in breaching the latter is 71.00.

Short positions require witnessing a clear break of the 68.40 support level, which puts the price under strong negative pressure, starting with its initial targets around 67.80, while the first official target is located around 67.10.

Note: IEA data due today and may cause high volatility

| S1: 68.40 | R1: 69.80 |

| S2: 67.80 | R2: 70.45 |

| S3: 67.10 | R3: 71.15 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations