After attempts to rise, the Canadian dollar found a strong resistance level of around 1.3550 to find the resistance above. It started to form negative pressure on the price within a sideways path it cannot breach until now. Technically, we find the Canadian dollar stable above the floor of support …

Read More »Oil is facing negative pressure and scrutiny is required 11/4/2023

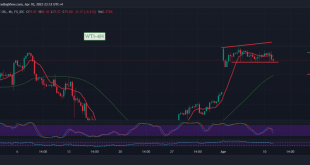

We remained neutral during the last technical report due to conflicting technical signals, explaining that risks are still high amid diverging technical indicators. As a reminder, we indicated that the price’s decline below 80.00 leads oil prices to visit 79.65, recording the lowest 79.66. Technically, we tend to be negative …

Read More »Gold is still above support 11/4/2023

Mixed trading dominated gold prices during last Monday’s session, to start to decline after it recorded its highest level of $2007, within an additional downward trend that tested the 1980 support floor. Technically, and by looking closely at the 240-period chart, we find that gold prices are still stable above …

Read More »Oil needs to monitor price behavior 6/4/2023

Due to conflicting technical signals, we adhered to intraday neutrality during the previous technical report, explaining the importance of monitoring the price from below 79.20 and above 80.85. Technically, prices failed to stay long above the resistance level of 80.85. Therefore, the stochastic indicator gradually lost bullish momentum, supporting the …

Read More »Gold is trying to resume its rally 6/4/2023

Trading tended to be positive and continued to control the prices of the yellow metal during the previous trading session as part of a gradual rise towards the target of the previous report at the price of 2040, to suffice with recording the highest $2032 per ounce. Technically, and with …

Read More »Oil needs to monitor price behavior for the 2nd session 5/4/2023

Due to the high level of risks amid conflicting technical signals, we adhered to intraday neutrality during the previous technical report, explaining that confirming a breach of 81.00 may extend oil’s gains to 81.60, recording its highest level at 81.80. Technically, the inconsistency in the technical signals is still present. …

Read More »Gold continues the bullish rally 5/4/2023

Gold prices continue to achieve substantial against USD, in line with the bullish trend, as we expected during the previous trading session, touching the second official stop at $2025 per ounce. Technically, and with a close look at the 240-minute chart, we find that the relative strength index continues to …

Read More »CAD: negative pressure is in place 4/4/2023

As we expected, the Canadian dollar declined significantly within the negative outlook, touching the official target achieved yesterday at 1.3460, recording the lowest 1.3411. Technically, the bearish trend is still the most dominant in the pair’s movements, and we find that the simple moving averages continue their negative pressure on …

Read More »Oil needs to monitor price behavior 4/4/2023

Strong rises were witnessed in the prices of US crude oil futures contracts, to start its first weekly dealings on a rising price gap under the influence of the OPEC decision, to record its highest level of $81.50 per barrel. Technically, By looking closely at the 240-minute chart, we find …

Read More »Gold derives its strength from consolidation above support 4/4/2023

Gold prices failed to break the pivotal support floor published during the previous analysis at 1960, explaining that it represents the key to protecting the official bullish trend, returning to the bullish rebound towards 1990, to end its daily dealings above the support mentioned above. Technically, the overall bullish trend …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations