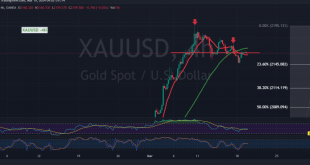

Gold prices commenced the first trading session of last week with a pronounced bearish sentiment, slipping below the significant threshold of $2400 per ounce. At the time of drafting this report, prices had dipped to approximately 2361 during the morning session. Technically, on today’s 4-hour chart analysis, we observe gold …

Read More »CAD below the psychological barrier 29/3/2024

The Canadian dollar encountered resistance at the psychological barrier of 1.3600, a level that has historically provided stability and recently led to negative trading momentum, with the pair currently hovering around 1.3550. In terms of technical analysis today, our inclination leans towards a bearish outlook, albeit cautiously, as we observe …

Read More »Oil is getting positive signals 29/3/2024

US crude oil futures prices surged, marking significant gains and making a decisive push towards the psychological resistance barrier of $83.00, reaching a peak of $83.17 per barrel. Technically, our trading outlook remains optimistic, with the simple moving averages providing positive reinforcement and buoyed by encouraging signals from the 14-day …

Read More »Gold continues to hit record highs 29/3/2024

Gold prices continue their ascent, reaching historic peaks at $2236 per ounce in the previous trading session, surpassing the previous record of $2224. From a technical perspective, today’s movements show stability above the resistance level of 2222, with the simple moving averages providing support for the daily upward price trend. …

Read More »CAD maintains the upward trajectory 22/3/2024

Positive momentum continued to drive the movements of the Canadian dollar, with the currency reaching its peak at 1.3565 after breaking through the psychological resistance level of 1.3500 and establishing stability above it. In terms of technical analysis today, we maintain a bullish outlook, supported by the currency’s ability to …

Read More »Oil may witness a temporary decline 22/3/2024

Mixed trading characterized the movement of US crude oil futures contracts, exhibiting both upward and downward movements and currently hovering near its lowest level at $80.45 per barrel. From a technical standpoint, we lean towards a bearish bias in our trading outlook, albeit cautiously. This is supported by the beginning …

Read More »Gold records historic peaks 22/3/2024

The price of gold experienced a positive trading session, reaching significant gains and continuing its upward trajectory to achieve new historical peaks, with a peak at $2222 per ounce. In terms of technical analysis today, observing the 240-minute timeframe chart, the upward movement halted after reaching $2222, and the price …

Read More »CAD is gradually rising 19/3/2024

The Canadian dollar’s movements during the previous trading session followed an upward trend, with the currency breaking through the resistance level at the psychological barrier of 1.3500 and reaching a peak of 1.3543. Today’s technical analysis suggests a positive outlook, with a preference for stability above 1.3500 and support from …

Read More »Oil making notable gains 19/3/2024

Yesterday, US crude oil futures prices surged as anticipated in the previous technical report, reaching a peak at $82.46 per barrel. From a technical standpoint, our trading bias remains positive, supported by the consistent movement within the upward price channel. Additionally, the presence of the simple moving averages and the …

Read More »Gold is waiting for a movement signal 19/3/2024

Gold prices experienced mixed trading during the first trading session of the week, testing the main support level around 2145 and maintaining positive stability above it. From a technical perspective, examining the 4-hour time frame chart reveals that gold remains stable above the previously breached resistance, now acting as a …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations