Record Highs and Technical Optimism In the previous trading session, US crude oil futures soared, reaching a peak of $77.08 per barrel. Technically, a positive outlook prevails, supported by consistent movement within an ascending price channel depicted on the 4-hour chart, alongside encouraging signals from the simple moving averages. Preferred …

Read More »Oil Prices Dip in Asian Trading Amid Easing Middle East Tensions

In early Asian trading on Monday, oil prices saw a slight decline following Israel’s announcement of the cessation of strikes on the southern Gaza Strip, providing some relief from concerns about potential disruptions to supplies from the Middle East. Here’s a closer look at the key developments shaping oil markets: …

Read More »Oil prices are heading for weekly gains

In the realm of global markets, oil prices surged in early Friday trading, poised for significant weekly gains against a backdrop of escalating tensions in the Middle East. The region’s geopolitical landscape has been tumultuous, with Israel rejecting a ceasefire proposal from the Palestinian Islamic Resistance Movement (Hamas), further fueling …

Read More »China’s Consumer Prices Continue Decline in January

Consumer prices in China persisted in their downward trajectory for the fourth consecutive month in January, highlighting the hurdles facing the world’s second-largest economy in its quest for robust recovery. Consumer Price Index Data: Decline Year-on-Year, Modest Uptick Monthly Data released by the National Bureau of Statistics on Thursday revealed …

Read More »Oil touches the first target 8/2/2024

In the latest trading session, US crude oil futures contracts notched a significant milestone by hitting the initial target set at $74.00, culminating in a peak of $74.24 per barrel. Technical Analysis: Moving Averages and Relative Strength Index Signal Positivity A technical analysis reveals that simple moving averages are exerting …

Read More »EIA Raises Forecast for Global Oil Demand Growth

EIA Raises Forecast for Global Oil Demand Growth In a recent statement, the US Energy Administration (EIA) announced a revised forecast for global crude oil demand, indicating an increase in growth projections for both 2024 and 2025. According to the statement released on Tuesday, the EIA anticipates a growth of …

Read More »Oil Prices Rise Amid Stable US Production Outlook

Steady US Production Forecasts Boost Oil Market Confidence Oil prices saw a modest uptick on Wednesday, fueled by optimistic projections regarding the stability of US oil production growth over the coming years. This positive outlook has helped alleviate concerns surrounding potential oversupply in the market, providing some relief to investors …

Read More »Oil touches the first target 7/2/2024

US Crude Oil Futures Surge, Meeting Expected Targets The anticipated upward trajectory in US crude oil futures contracts materialized as forecasted, with prices reaching and surpassing the initial target outlined in our previous technical analysis, touching $73.60 and soaring to a peak of $73.78 per barrel. Technical Analysis: Positive Signals …

Read More »China’s imports of key commodities make a strong new year start

China’s imports of major commodities have made a strong start to the new year. However, caution is needed due to the potential influence of the Lunar New Year holidays, which fall entirely in February this year. This could have boosted imports of crude oil, liquefied natural gas (LNG), thermal coal, …

Read More »Oil gets a temporary positive signal 6/2/2024

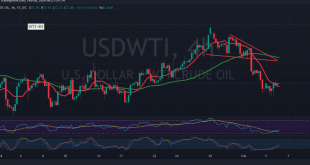

Analysis of Market Movements and Technical Indicators US crude oil futures contracts experienced mixed trading dynamics during the previous session, oscillating between upward and downward movements. The price fluctuated within a range, reaching its lowest point at $71.43 and concluding daily trading at approximately $72.74 per barrel. Market Dynamics Mixed …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations