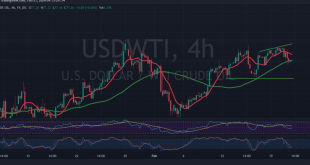

The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark. Technical Analysis …

Read More »Oil prices to be monitored 21/2/2024

US crude oil futures experienced a notable rally in the previous trading session, nearing the first upward target mentioned in the previous technical report at $78.70. However, the price faced resistance and retreated, reaching a peak of $78.50 per barrel before encountering downward pressure. Technical Analysis Overview Examining the technical …

Read More »Russia Affirms Commitment to OPEC+ Quota Amid Oil Refining Decline

Russian Deputy Prime Minister Alexander Novak reaffirmed Moscow’s commitment to adhere to its quota within the OPEC+ agreement, despite a recent decline in oil refining. Novak’s statement, reported by the Russian TASS news agency on Tuesday, underscores Russia’s dedication to the collaborative effort led by the Organization of the Petroleum …

Read More »Oil maintains an upward trend 20/2/2024

US crude oil futures experienced quiet yet positive trading during yesterday’s US market holiday, reaching its highest level at $78.52 per barrel. Technical Analysis Reinforces Upward Trend The technical outlook for oil prices remains unchanged, with trading continuing within an upward trend observed within the ascending price channel depicted on …

Read More »China’s tourism revenues during the Lunar New Year holiday exceed the pre-pandemic level

Official data has revealed a remarkable surge in tourism revenues in China during the Lunar New Year holiday, which concluded on Saturday, with a staggering year-on-year increase of 47.3 percent. This surge has not only surpassed 2019 levels but also underscored the robustness of domestic tourism amid an extended holiday …

Read More »Weekly Financial Recap: US Data Dominates Market Sentiment

In the pulse of the financial world, the spotlight of the past week fell squarely on key US economic indicators, particularly inflation data, igniting a flurry of activity and recalibration across markets. Inflation Insights Headline US inflation for January came in at 3.1%, a modest improvement that fell slightly short …

Read More »Oil building on support 16/2/2024

Support Holds Strong:The support level at 75.50, highlighted in the previous technical report, proved effective in halting the downward momentum of US crude oil futures prices. It is emphasized that the resumption of the downward trend hinges upon breaching this critical support level. Technical Analysis Insights:A closer examination of oil …

Read More »Oil Gives up its Gains 15/2/2024

US Crude Oil Futures Reach Target Before Facing Resistance US crude oil futures prices surged to achieve the initial upward target as anticipated in the previous technical report, hitting a peak of $78.74 per barrel, surpassing the first milestone at $78.55. Technical Analysis Highlights: During the trading session, oil prices …

Read More »Oil touches the desired target 14/2/2024

US crude oil futures maintained a positive trajectory in the previous technical report, reaching the target price of $78.10 and hitting a high of $78.44 per barrel. Technically, the outlook remains optimistic, with the price receiving consistent support from simple moving averages, contributing to an upward trend. Additionally, positive signals …

Read More »OPEC Upgrades Economic Growth and Oil Demand Outlook

In its latest monthly report, OPEC has revised its global economic growth forecasts upward for 2024 and 2025, projecting a more optimistic outlook with expectations set at 2.7% and 2.9% respectively. On the oil front, OPEC maintains a steady outlook for global oil demand growth, with projections holding firm at …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations