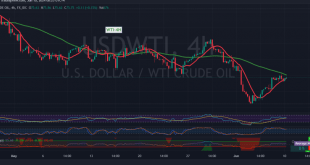

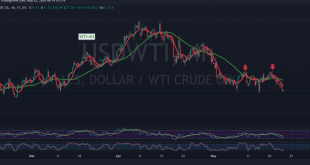

WTI crude oil futures experienced mixed trading, attempting to bounce back from recent lows by utilizing the 75.25 support level. Currently trading at $75.75 per barrel, the commodity faces a bearish outlook due to several technical factors. The 50-day simple moving average continues to act as a strong resistance barrier, …

Read More »Weekly Recap: Global Markets Navigate Inflation Concerns, Policy Shifts, and Oil Uncertainty

As May draws to a close and June begins, financial markets worldwide find themselves at a critical juncture. Economic data reveals a mixed picture, with signs of easing inflation tempered by ongoing concerns about growth and the potential for further policy tightening. Central banks grapple with diverging paths, while oil …

Read More »Oil Prices Ease on Stronger Dollar, Higher-for-Longer Rates Outlook

Oil prices declined on Thursday as the stronger U.S. dollar and expectations of prolonged high interest rates raised concerns about potential demand reduction. Brent futures dropped 0.3% to $83.34 a barrel, while U.S. West Texas Intermediate (WTI) crude fell 0.3% to $79.00. Both benchmarks are on track for monthly losses, …

Read More »WTI Crude Oil Prices Face Potential Correction 30/5/2024

WTI crude oil experienced mixed trading yesterday, oscillating between gains and losses while approaching the previously identified target of 80.75. The commodity reached an intraday high of $80.60 per barrel before encountering resistance. Technical analysis reveals a shift in momentum. The price failed to sustain above the $80.00 level and …

Read More »Oil prices slide ahead of US EIA Data

Oil prices fell on Thursday as markets await the latest U.S. crude oil stockpiles data. Resilient U.S. economic activity suggests that borrowing costs will remain higher for longer, potentially impacting demand. Brent futures lost 9 cents to trade at $83.52 a barrel, while U.S. West Texas Intermediate (WIT) crude was …

Read More »Oil is making notable gains 29/5/2024

WTI Crude Oil Prices Set for Further Gains, but Caution Advised WTI crude oil futures prices are on a clear upward trajectory, having recently surpassed the targeted levels of 79.30 and 79.70 and approaching the key psychological level of 80.50. The commodity reached an intraday high of $80.28 per barrel, …

Read More »WTI Crude Oil Prices Rise Amid Positive Technical Signals 28/5/2024

WTI crude oil futures prices have aligned with our previous technical forecast, reflecting a downward trend while trading below the $77.70 resistance level. However, as anticipated, a consolidation above this level triggered a recovery, pushing prices to a high of $78.90 in early trading today. Technical Indicators Support Potential for …

Read More »Market Drivers – US Session, May 28

Bitcoin closed on an upward trajectory, driven by news of collaboration between Argentina’s Securities and Exchange Commission and El Salvador. The two countries are exploring further adoption of cryptocurrencies. BTC’s global spread closed at $69,528 per unit, slightly higher than the previous day’s closing price of $68,489. However, the larger-cap …

Read More »Financial Markets’ Weekly Recap: FOMC Minutes, Inflation Attract Most Attention

The minutes of the latest Federal Reserve’s monetary policy meeting as well as inflation data attrac1ted most attention across trading markets for the week. The US dollar closed last week’s trading in an upward direction on the back of signals as well as messages included in FOMC Minutes for May’s …

Read More »Oil paves the way for further decline 23/5/2024

US crude oil futures experienced a significant decline yesterday, aligning with the negative outlook projected in the previous technical report. The prices hit the target levels of $77.40 and $76.75, recording a low of $76.85 per barrel. The bearish trend remains the dominant scenario for today’s trading session, supported by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations