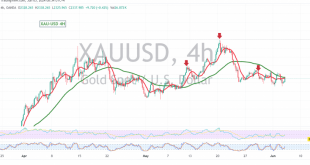

Gold prices remain confined within a narrow sideways range, bounded by the 2313 support level and the 2340 resistance level. Technical Outlook: Analysis of the 240-minute chart reveals a bearish flag pattern formation, indicating a potential continuation of the downward trend. The 50-day simple moving average is exerting negative pressure, …

Read More »Gold Technical Analysis: Corrective Decline Likely to Continue 13/6/2024

Gold prices experienced mixed trading in the previous session, influenced by the Federal Reserve’s interest rate decision. On the 4-hour chart, the key resistance level of 2340, as previously highlighted, successfully capped the upward movement. Gold’s inability to breach this level, combined with the persistent negative pressure from simple moving …

Read More »Gold Technical Analysis: Corrective Decline Expected to Continue 11/6/2024

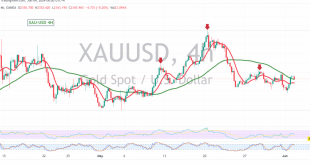

Gold’s price movement remains aligned with our previous technical assessment, continuing its downward corrective path, reaching a low of $2287.00 per ounce. On the 4-hour chart, we observe a clear break below the previously breached support level of 2318.00. This, coupled with negative pressure from the simple moving averages and …

Read More »Gold returns to the downward correction 10/6/2024

Gold prices experienced a sharp decline, surrendering recent gains due to a strengthening U.S. dollar following the release of strong U.S. jobs data last Friday. The precious metal, which previously struggled to break above the 2360 resistance level, has now fallen below the crucial 2318 support, reaching a low of …

Read More »Gold is looking for a stronger direction 5/6/2024

The technical landscape for gold remains largely unchanged, with the precious metal holding above the 2318 support level but facing resistance from the 50-day simple moving average. Despite yesterday’s upward movement, the 50-day simple moving average continues to exert downward pressure on the price. Additionally, the Stochastic oscillator is showing …

Read More »Gold Prices Face Key Resistance Level Amidst Mixed Signals 4/6/2024

Gold prices experienced positive momentum yesterday, approaching the significant resistance level of 2340 and reaching an intraday high of $2354.00 per ounce. However, the technical outlook presents a mixed picture, with both bullish and bearish signals vying for dominance. On the 4-hour timeframe chart, the 50-day simple moving average is …

Read More »Gold Prices Face Downward Pressure 30/5/2024

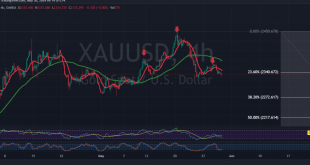

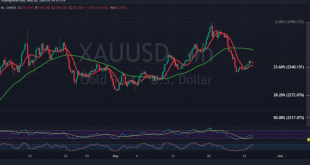

Gold prices have reversed their previously expected upward trajectory, breaking below the critical 2340 support level as outlined in the previous technical report. This development has initiated a bearish turn in the market, with prices currently trading below the 23.60% Fibonacci retracement level on the 4-hour timeframe chart. Further technical …

Read More »Gold building on support 28/5/2024

Gold Prices Poised for Further Upside, Technical Analysis Suggests Gold prices have found solid footing at the 2340 support level, as highlighted in the previous technical report. This support, coinciding with the 23.60% Fibonacci retracement level on the 240-minute timeframe chart, successfully halted the recent downward trend and propelled prices …

Read More »Gold Prices Surge on Positive Technical Outlook 28/5/2024

Gold prices experienced a significant boost in early trading this week, solidifying their position above the key psychological resistance level of $2400 per ounce. Previous technical analysis highlighted the potential for a direct recovery towards $2330 once prices held above $2295, a prediction validated by gold’s recent peak of $2358. …

Read More »Gold achieves goals 23/5/2024

Gold prices experienced significant losses yesterday, aligning with the downward corrective trend identified in the previous technical report. The price reached the forecasted target of $2375, recording its lowest level at $2366 per ounce. Examining the 4-hour time frame chart, several key technical indicators suggest the continuation of a downward …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations