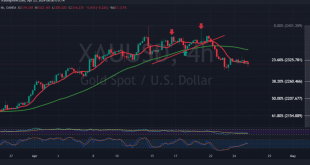

Gold prices recently found robust support at $2325, a level crucial for maintaining the short-term upward trend. This support prompted a modest rebound, with prices reaching a peak of $2346 per ounce. Analyzing the 240-minute time frame chart reveals a return to stability below the 50-day simple moving average, reinforcing …

Read More »Market Drivers; US Session, April 30

The US dollar started the week on the back foot in a week where interest rate cut bets by the Fed would be in the focus of interest amidst the FOMC event and the release of Non-farm Payrolls data for April.The US dollar lost Friday’s gains due to the yen’s …

Read More »Weekly Recap: Fed, Jobs Data, and Earnings in Focus

Last week, risk appetite improved, exerting pressure on safe haven assets such as the US dollar and gold, resulting in their decline after experiencing weekly losses. This shift favored risk assets, particularly US stocks. Markets are now anticipating significant events in the upcoming week, including the Federal Reserve’s interest rate …

Read More »Gold maintains the downward path 25/4/2024

The rise in gold prices that began during the previous trading session stopped when the price collided with the 2335 resistance level, forcing it to trade within the negative range. From the angle of technical analysis today, by looking at the 240-minute time frame chart, we find the price stable …

Read More »Gold Stays Firm Ahead of US GDP Data

Buoyed by market demand in the safe haven metal, gold prices have embraced the task of recovering from recent losses amid a stronger US dollar and rising US Treasury yields. The market became more stable as a result of the Middle East tensions de-escalating, which also reduced demand for gold …

Read More »Gold stable below resistance 24/4/2024

Gold prices experienced a notable rebound, finding support amidst a decline in the US dollar following the release of negative economic data. The precious metal reached its peak at $2,334 per ounce. In terms of technical analysis today, upon examining the 4-hour timeframe chart, it’s evident that the simple moving …

Read More »Market Drivers, US Session, April 23

Improved risk appetite on Tuesday impacted the US dollar, which is -0.44% down, at the 105.68 mark, while the weaker than expected US PMIs kept the American currency under pressure.The ECB is expected to cut rates in June, while the Fed is still seen reducing its rates in September, with …

Read More »Gold touching the desired targets and negativity remains 23/4/2024

Gold prices experienced significant losses in the previous trading session, aligning with the corrective decline anticipated in the preceding technical report. The prices reached the specified targets at 2325, hitting a low of $2295 per ounce. From a technical analysis perspective today, a detailed examination of the 4-hour timeframe chart …

Read More »Gold may face a downward correction 22/4/2024

Gold prices commenced the first trading session of last week with a pronounced bearish sentiment, slipping below the significant threshold of $2400 per ounce. At the time of drafting this report, prices had dipped to approximately 2361 during the morning session. Technically, on today’s 4-hour chart analysis, we observe gold …

Read More »Weekly Recap: Stocks Fall as Tech Loses Ground, Geopolitical Unrest Persists

Reports about missile attacks hitting Iran in the early hours of Friday prompted a flight for safety across financial markets. Financial markets immediately experienced risk aversion. US stock index futures were down between 0.55% and 0.8% in the early European session, reflecting the risk-averse environment in the market. The US …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations