Last week, risk appetite improved, exerting pressure on safe haven assets such as the US dollar and gold, resulting in their decline after experiencing weekly losses. This shift favored risk assets, particularly US stocks. Markets are now anticipating significant events in the upcoming week, including the Federal Reserve’s interest rate decision, US employment data releases, and key earnings reports.

In contrast to recent weeks dominated by geopolitical tensions, particularly in the Middle East, last week saw a notable absence of such elements. Wall Street and other global financial markets experienced a weekend free from mutual attacks between Iran and Israel, a departure from the recent norm.

Various factors contributed to bolstering risk appetite in the markets. Notably, positive economic data and earnings reports emerged from major players among the “Great Seven” technology giants, further supporting investor sentiment.

The easing of geopolitical tensions marked a notable shift at the end of the previous week. Iranian-Israeli strikes ceased, bringing an end to two weeks of tit-for-tat attacks and contributing to a sense of calm in the region.

Economic data took center stage in driving price movements across global financial markets last week, with a particular focus on US data. The close correlation between US economic indicators and expectations regarding the Federal Reserve’s future monetary policy path sparked notable fluctuations in prices.

The Personal Consumption Expenditures (PCE) index in the United States remained unchanged in March compared to the previous month, holding steady at 0.3%. However, the annual reading of the index showed a rise of 2.7% in March compared to the previous year’s reading of 2.5%, aligning with market expectations that had anticipated stability in the monthly figure.

Excluding the volatile food and energy prices, the monthly PCE index increased by 0.3%, matching both the previous reading and market expectations. On an annual basis, the index climbed by 2.8% in March compared to the same period last year, surpassing market forecasts set at 2.6%.

The uptick in inflation rates in the United States has fueled speculation about the Federal Reserve’s stance on interest rates. There is a growing sentiment that the Fed might delay rate cuts until inflation shows a sustained trajectory toward the central bank’s target of 2.00%.

The US GDP index fell below market expectations in the first quarter of 2024, marking a decline from the same period last year and indicating a worsening economic situation. The index dropped to 1.6%, compared to 3.4% in the first quarter of the previous year, falling short of expectations that projected a milder decline to 2.5%, according to data released on Thursday.

In contrast, the Personal Consumption Expenditures Price Index, a key inflation measurement closely monitored by the Federal Reserve, surged by 3.4% in the first quarter of 2024, compared to a previous reading of 1.8%. This uptick highlights ongoing inflationary pressures in the US economy, with inflation levels remaining significantly above the Federal Reserve’s official target. Such persistent inflation trends may deter the central bank from implementing rate cuts in the near future.

The durable goods orders index saw a notable increase in March, rising to 2.6% compared to the previous reading of approximately 0.7%. This surge surpassed market expectations for the period, signaling growing confidence among American consumers in both current and future economic conditions, prompting them to invest in high-cost durable goods.

Market analysts view this consumer confidence as a significant factor that could influence the Federal Reserve’s decision-making process regarding interest rate cuts. This sentiment suggests a potential delay in rate cuts, with implications for the US dollar’s strength, which saw a positive impact as a result.

On Tuesday, a set of data revealed a slowdown in US economic activity. The Composite Purchasing Managers’ Index (Global Edition) by Standard & Poor’s dropped to 50.9 in April from 52.1 in March, falling slightly below market expectations and marking its lowest level in four months. Concurrently, the labor market experienced its first contraction since June 2020, particularly noticeable in the service sector, indicating a potential slowdown in employment trends.

Despite these indicators, there was a slight decrease in inflation rates, although input prices remained elevated. Meanwhile, in the Eurozone, there was an improvement in German consumer confidence as reflected in the GFK Consumer Confidence Index, which rose to -24.2 points from the previous reading of -27.3 points. While still in negative territory, this improvement suggests progress towards less negative levels, supporting the euro’s movement and contributing to the US dollar’s relative weakness.

Gold and USD

Gold prices remained relatively unchanged at the end of last week compared to the previous week’s close, mirroring the overall trend in commodities as gold also experienced weekly losses. Several factors contributed to bolstering risk appetite in the markets, with a significant driver being the de-escalation of geopolitical tensions in the Middle East between Iran and Israel, resulting in a cessation of military actions between the two nations.

Positive economic data released during the week further buoyed investor confidence. The earnings reports from various technology giants were particularly impactful, with Microsoft surpassing market expectations in its current fiscal quarter. Microsoft’s profits soared to $2.94 per share, accompanied by revenues reaching $61.9 billion for the same period. These figures exceeded Wall Street’s anticipated profits of $2.83 per share and revenues of $60.88 billion.

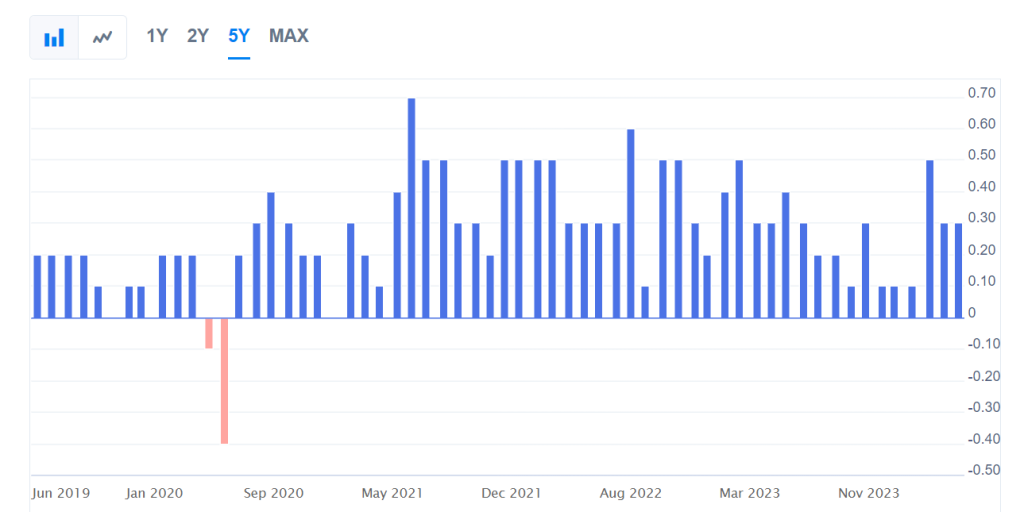

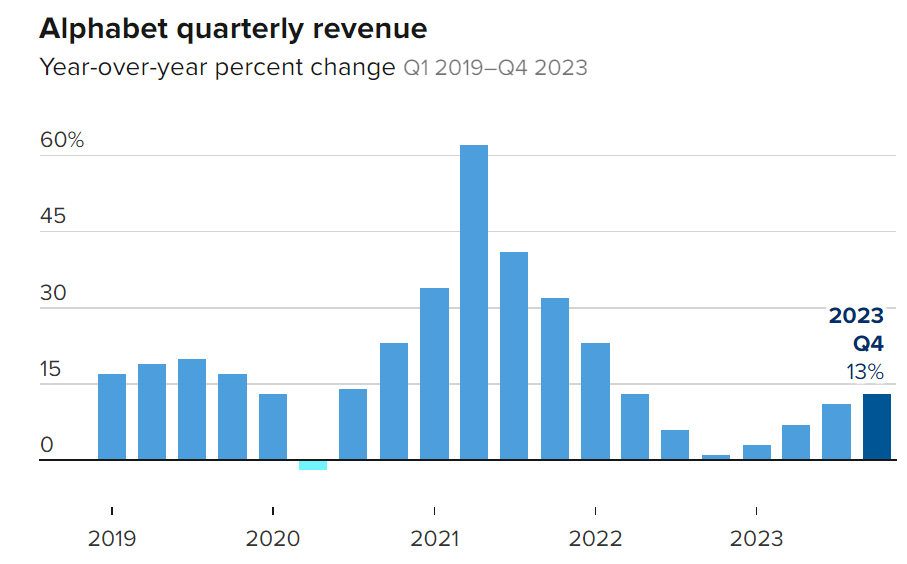

Alphabet also saw a surge in its shares by approximately 10% following its announcement of profits reaching $1.89 per share, surpassing market expectations of $1.51 per share.

Another notable market movement involved the Japanese yen, particularly driven by expectations surrounding the Bank of Japan’s Monetary Policy Committee meeting. The bank’s decision to maintain interest rates and monetary policy measures unchanged signaled a conservative approach towards rate hikes in the near future. Consequently, the Japanese yen experienced a significant decline, reaching its lowest levels in over 30 years as a result of the central bank’s decision.

Next Week

Next week is poised to be a pivotal period for global financial markets, with a flurry of significant events expected to drive price movements. It will be a heavy trading week where all developments, including economic data releases, earnings reports, and central bank meetings, should be closely monitored.

The Federal Reserve’s meeting is anticipated to have a substantial impact on market transactions for the upcoming week. As the central bank representing the largest economy globally, its decisions carry significant weight among major central banks worldwide.

While no new decisions are expected to emerge from the Federal Reserve in the coming week, market participants will closely scrutinize any statements or indications from Jerome Powell, Chairman of the Federal Open Market Committee, and other officials. Recent statements from Fed officials have emphasized the need for more evidence of sustainable progress towards the central bank’s inflation target of 2.00% before considering any significant policy adjustments.

Additionally, US employment indicators will continue to be a focal point for market investors. The employment data plays a crucial role in shaping the Federal Reserve’s monetary policy decisions, making it essential to monitor closely for any insights into the labor market’s health and its potential impact on future policy directions.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations