As Christine Lagarde, President of the European Central Bank (ECB), addresses the media regarding the ECB’s decision to maintain key interest rates unchanged in March, she emphasizes the rationale behind the decision and responds to queries from the press. Lagarde begins by outlining the ECB’s assessment of the current economic …

Read More »Currencies Overview: Dollar Weakens Amid Fed Rate Cut Speculation

The U.S. dollar saw downward pressure on Thursday as market anticipation of potential rate cuts by the Federal Reserve grew stronger. This sentiment prevailed as Fed Chair Jerome Powell commenced his two-day testimony before Congress, suggesting that rate cuts might be warranted later this year. Powell’s Testimony Drives Dollar Lower …

Read More »European stocks fell ahead of ECB interest rate decision

On Thursday, European shares experienced a decline as investors exercised caution ahead of the European Central Bank’s (ECB) interest rate decision. However, Virgin Money shares saw an upsurge following expressions of interest from Britain’s National Building Society regarding a potential acquisition. As of 0815 GMT, the European STOXX 600 index …

Read More »Will the ECB Move Swiftly to Cut Interest Rates or Opt to Wait Until June?

As anticipation mounts ahead of the European Central Bank’s interest rate decision scheduled for tomorrow, Thursday, analysts widely anticipate a status quo stance, with the bank likely to maintain interest rates unchanged at 4.50%. With this expectation in mind, market attention is poised to shift towards the bank’s economic forecast …

Read More »Euro breaks resistance, eyes the ECB 7/3/2024

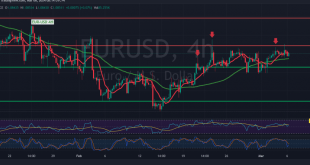

In our previous technical report, we maintained a neutral stance due to conflicting technical signals. We highlighted that the potential for an upward trend hinged on the confirmation of the EUR/USD pair surpassing the resistance level of 1.0860. Such confirmation would likely bolster the pair’s momentum towards 1.0930, with the …

Read More »European Stocks Find Stability Ahead of Key Economic Data and Powell’s Testimony

In early trading on Wednesday, European stocks stabilized, with positive gains offsetting losses, ahead of the release of key economic data for the euro zone and Federal Reserve Chairman Jerome Powell’s testimony before Congress. The European STOXX 600 index remained steady at 0809 GMT, showing signs of stability. The basic …

Read More »Euro needs to confirm the trend 6/3/2024

The technical outlook for the EUR/USD pair remains consistent, with no significant deviation from the previous analysis. The pair continues to trade within the established sideways price range, bounded by support near 1.0800 and resistance around 1.0860. Examining the 4-hour chart, we observe that the 50-day simple moving average continues …

Read More »European stocks open lower and markets await data

At the start of trading on Tuesday, European stocks faced a downturn, echoing the performance of Asian stocks, as investors remained cautious amidst pledges from China that failed to bolster market sentiment. This cautious sentiment prevailed ahead of the release of key economic data from both the euro zone and …

Read More »Euro looking for a stronger direction 5/3/2024

The EUR/USD pair has exhibited a slight upward bias during the initial trading sessions of the week. However, this upward momentum has been limited, with the pair struggling to consolidate above the key resistance level of 1.0860. On the technical front, analyzing the 4-hour time frame chart reveals that the …

Read More »Euro expected to appreciate only slightly against the US dollar

Economists expect the EUR/USD exchange rate to end the year at 1.1000. Limited upside potential is also suggested.Economists see limited upside potential for EUR/USD this year. By the end of the year, economist expect prices to be around 1.1000. The Euro is likely to appreciate slightly over the next few …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations