As anticipation mounts ahead of the European Central Bank’s interest rate decision scheduled for tomorrow, Thursday, analysts widely anticipate a status quo stance, with the bank likely to maintain interest rates unchanged at 4.50%. With this expectation in mind, market attention is poised to shift towards the bank’s economic forecast statement, where insights into economic growth rates, inflation trends, wage dynamics, and unemployment projections for the upcoming period will be unveiled for the first time this year.

Projections from the European Central Bank are expected to signal a modest dip in the inflation rate for the current year, coupled with a steadfast commitment to attaining the target rate of 2% by mid-next year. Christine Lagarde, President of the European Central Bank, is anticipated to underscore the incremental uptick in wage growth and its pivotal role in assuaging mounting risks surrounding inflationary prospects. Lagarde has consistently emphasized the necessity for the disinflation process to advance further until the central bank attains a level of confidence in its sustainability.

last Friday, Goldman Sachs revised its expectations, projecting that the European Central Bank would embark on interest rate cuts commencing in June, prompted by data revealing inflation figures surpassing initial forecasts within the region. According to their report, Goldman Sachs now anticipates five interest rate cuts of 25 basis points each year, as opposed to the previously predicted six. Looking ahead to the following year, Goldman Sachs foresees two rate cuts of 25 basis points, compared to their earlier projection of one.

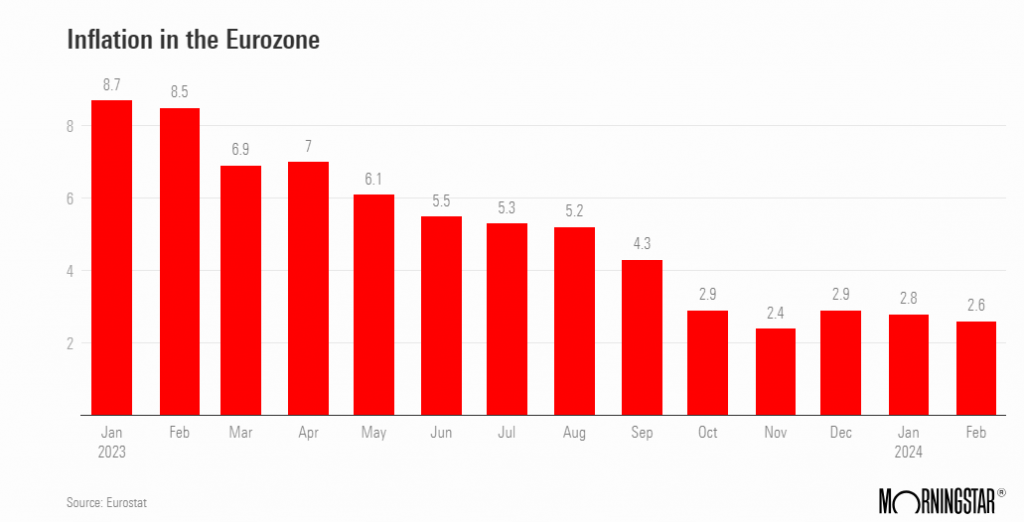

Turning to economic indicators, February saw the inflation rate in the eurozone decrease to 2.6% from the previous month’s 2.8%, aligning closely with the anticipated figure of 2.5%, as per data released by the European Statistics Office (Eurostat). Excluding volatile food and fuel prices, the core inflation index also experienced a decline from 3.3% to 3.1%, falling below expectations of 2.9% while persisting above the European Central Bank’s 2% target.

Most conservative council members, including Christine Lagarde, concur that additional labor market data is necessary before considering a reduction in the deposit rate from its current record level of 4.00%.

Lagarde emphasized last week that the forthcoming first-quarter wage data, anticipated in May, holds significant importance for the European Central Bank (ECB). This assertion heightens the likelihood that June will mark the commencement of interest rate cuts by the ECB for the first time this year.

An overwhelming majority of analysts, comprising 46 out of 73, anticipate the central bank’s inaugural deposit rate cut of 25 basis points to 3.75% in June. This consolidated perspective starkly contrasts with the 45% reported in a January poll, underscoring a notable shift in sentiment. In summary, an early rate cut by the ECB could potentially weaken the euro and elevate the risk of heightened inflation.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations