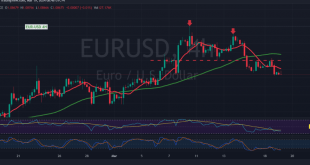

The EUR/USD pair faced strong selling pressure near the 1.0960 resistance level, leading to negative trades and a return to stability below the psychological barrier of 1.0900. From a technical perspective today, examining the 4-hour time frame chart reveals a bearish technical formation supporting the potential for further decline, along …

Read More »European Stocks Open Slightly Higher Amidst Caution

European stocks opened with modest gains on Monday, with the basic resources sector leading the way, albeit tempered by investor caution ahead of euro zone inflation data. Key Points Market Movement: The European STOXX 600 index rose 0.1 percent by 0816 GMT, with the basic resources sector experiencing the most …

Read More »European Shares Show Muted Activity Yet Head for Weekly Gains

European shares maintained a subdued stance on Friday, balancing strength in the telecommunications sector against a broader sell-off in global equities triggered by hotter-than-expected U.S. inflation figures, which dampened expectations of a June rate cut. Telecom Sector Strength Counters Equities Sell-off The pan-European STOXX 600 index remained flat, as of …

Read More »Euro facing strong resistance 15/3/2024

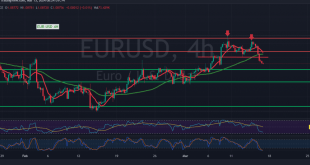

The euro continues its gradual ascent against the US dollar, maintaining consistent technical patterns for the third consecutive session. Analyzing the 240-minute timeframe chart, the simple moving averages persist in guiding the price from below, reinforcing the bullish technical structure evident on the chart. With daily trading sustained above the …

Read More »European Stocks Edge Higher Amid Data Anticipation

European stocks opened on a positive note on Thursday, buoyed by upbeat corporate reports, although investor sentiment remained cautious ahead of crucial economic data releases from the United States. The European STOXX 600 index, a barometer of regional market performance, edged 0.2 percent higher by 08:11 GMT, lingering near its …

Read More »Currency Markets Reflect Cautious Optimism Ahead of Awaited Data

Amidst a landscape of currency markets characterized by cautious optimism, investors around the globe find themselves on the precipice of pivotal decisions, with the trajectory of the world’s largest economy poised to influence exchange rates and trading sentiments. Data-Driven Anticipation The currency arena resonates with anticipation as market participants eagerly …

Read More »Euro trying to break through the resistance 14/3/2024

The euro continues its gradual ascent against the US dollar, maintaining consistent technical patterns for the third consecutive session. Analyzing the 240-minute timeframe chart, the simple moving averages persist in guiding the price from below, reinforcing the bullish technical structure evident on the chart. With daily trading sustained above the …

Read More »European Shares Reach New Highs Amid Positive Corporate Updates

European shares surged to new record highs on Wednesday, buoyed by gains in retail and utility stocks following upbeat corporate announcements. As investors eagerly awaited industrial production data from the region, the pan-European STOXX 600 index rose by 0.1% by 9:13 GMT, building on the momentum from Tuesday’s record-high close. …

Read More »Forex Overview: Dollar Stabilizes as Markets Digest Higher-Than-Expected Inflation in America

Dollar Stability Amid Inflation Surge: The dollar showed signs of stability against major currencies on Wednesday as traders gauged the potential impact of higher-than-expected inflation data on the Federal Reserve’s interest rate decisions slated for June. Surge in US Consumer Price Index: February witnessed a robust rise in the US …

Read More »Euro maintains the upward path 13/3/2024

The technical outlook for the EUR/USD pair remains consistent with a gradual upward trend, with no significant deviations observed as it endeavors to sustain its upward trajectory. Upon closely examining the 240-minute timeframe chart, it is evident that the simple moving averages continue to support the price from below, reinforcing …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations