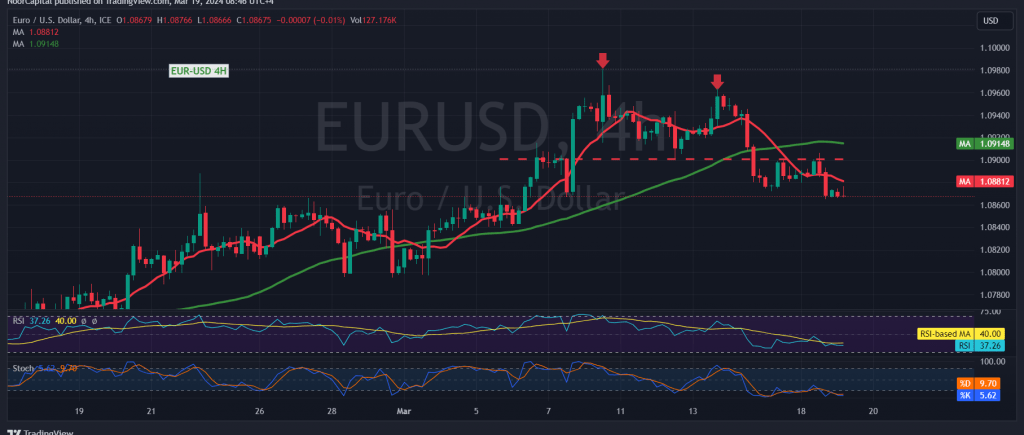

The EUR/USD pair faced strong selling pressure near the 1.0960 resistance level, leading to negative trades and a return to stability below the psychological barrier of 1.0900.

From a technical perspective today, examining the 4-hour time frame chart reveals a bearish technical formation supporting the potential for further decline, along with negative pressure from the simple moving averages.

Therefore, the bearish bias is favored for today’s session, particularly if the pair falls below 1.0860, which could pave the way for a visit to the official target station at 1.0765.

It’s important to note that while consolidating above 1.0900 may delay the decline, it doesn’t eliminate the possibility. A retest of 1.0960 might occur before a continuation of the downward trend. Furthermore, if the price consolidates above 1.0960, it could invalidate the downward trend, potentially leading the euro to recover against the dollar, initially targeting 1.1000.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations