Oil, Crude, trading

Read More »Oil reaches the desired target 6/3/2024

US crude oil futures prices experienced a significant decline, relinquishing earlier gains and confirming the bearish outlook outlined in yesterday’s analysis. The prices touched the initial target of $77.70, reaching a low of $77.55 per barrel. Upon closer examination of the 4-hour chart, it is evident that the price remains …

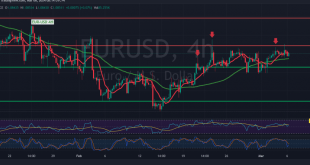

Read More »Euro needs to confirm the trend 6/3/2024

The technical outlook for the EUR/USD pair remains consistent, with no significant deviation from the previous analysis. The pair continues to trade within the established sideways price range, bounded by support near 1.0800 and resistance around 1.0860. Examining the 4-hour chart, we observe that the 50-day simple moving average continues …

Read More »Dow Jones is witnessing a downward trend 5/3/2024

Oil, Crude, trading

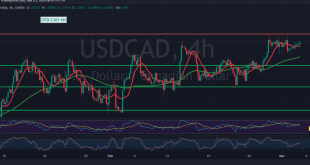

Read More »CAD building on support 5/3/2024

The Canadian Dollar pair has made modest upward attempts, finding support around the 1.3510 level and reaching its peak at 1.3585 during the previous trading session. In terms of technical analysis today, we cautiously lean towards a positive outlook, contingent upon the pair maintaining stability above the mentioned support level …

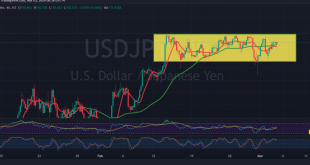

Read More »USD/JPY waiting for a signal 5/3/2024

japanese-yen

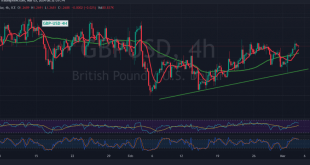

Read More »GBP trying positively 5/3/2024

Oil, Crude, trading

Read More »Oil is experiencing temporary negative pressure 5/3/2024

The previous trading session saw mixed activity in US crude oil futures contracts, with prices touching the official target at $80.40 per barrel before retracing slightly. Technically, the resistance level at $80.40 exerted downward pressure on oil prices, prompting a temporary retreat. Currently, prices are hovering near the lower end …

Read More »Euro looking for a stronger direction 5/3/2024

The EUR/USD pair has exhibited a slight upward bias during the initial trading sessions of the week. However, this upward momentum has been limited, with the pair struggling to consolidate above the key resistance level of 1.0860. On the technical front, analyzing the 4-hour time frame chart reveals that the …

Read More »Weekly Recap: US inflation dominates the market

Last week, the financial markets were shaped by significant data releases across several major economies, notably the United States and the eurozone. In the eurozone, data published by the European Statistics Office (Eurostat) on Friday indicated that the region’s annual harmonized consumer price index (HICP) rose by 2.6% in February, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations