japanese-yen

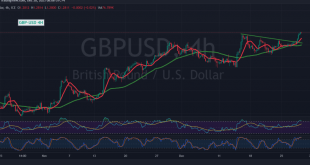

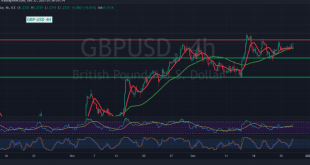

Read More »GBP outperforming USD 28/12/2023

Oil, Crude, trading

Read More »Oil is hovering around support 28/12/2023

US crude oil futures prices witnessed a downward trend during the previous trading session, invalidating the expected bullish scenario in which we relied on trading bases above 73.70 at the time of writing the technical report. Technically, by looking at the 4-hour time frame chart, we find that oil prices …

Read More »Euro extends its gains 28/12/2023

The upward trend continued to control the movements of the EUR/USD pair, as we expected, touching the official target required to be achieved during the previous technical report, located at the price of 1.1120, recording its highest level of 1.1122. On the technical side today, we are leaning towards positivity, …

Read More »Nasdaq maintains an upward trajectory 27/12/2023

Oil, Crude, trading

Read More »Dow Jones may resume rising 27/12/2023

Oil, Crude, trading

Read More »USD/JPY needs a confirmation signal 27/12/2023

japanese-yen

Read More »GBP needs additional momentum 27/12/2023

Oil, Crude, trading

Read More »Oil is recording notable gains 27/12/2023

US crude oil futures exhibited a significant uptrend in the previous trading session, leveraging robust support around $73.20 and reaching a peak of $76.14 per barrel. Technical indicators, including the positive alignment of simple moving averages and encouraging signals from the Relative Strength Index (RSI), contribute to the optimistic outlook. …

Read More »Euro continues its gradual rise 27/12/2023

The euro has maintained its upward trajectory against the US dollar, following the anticipated path outlined in the previous technical report. The currency successfully reached the targeted level of 1.1040, touching a peak of 1.1045. Technical Analysis Overview: Examining the 4-hour time frame chart reveals that the simple moving averages …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations