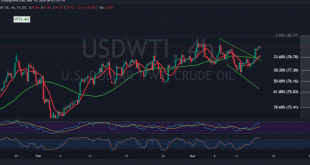

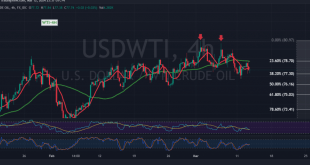

Over the past two consecutive sessions, our focus has been on monitoring the price behavior of oil due to conflicting technical signals and trading confined within defined trend boundaries. As previously highlighted in our technical report, an upward trend commenced upon crossing above the resistance level of 78.70, representing the …

Read More »Gold resumes its rise 14/3/2024

Gold prices have rebounded, resuming their official upward trajectory and negating the need for the retesting scenario outlined in the previous technical report. The metal settled with its lowest level recorded at $2157 per ounce. Today’s technical analysis, focusing on the 4-hour timeframe chart, indicates continued support from the simple …

Read More »Euro trying to break through the resistance 14/3/2024

The euro continues its gradual ascent against the US dollar, maintaining consistent technical patterns for the third consecutive session. Analyzing the 240-minute timeframe chart, the simple moving averages persist in guiding the price from below, reinforcing the bullish technical structure evident on the chart. With daily trading sustained above the …

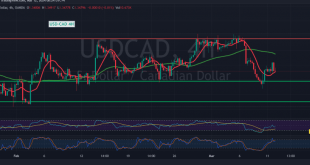

Read More »CAD hits the resistance 13/3/2024

In the previous trading session, the Canadian dollar experienced a limited upward trend, with movements pushing towards a retest of the psychological barrier resistance level of 1.3500, ultimately reaching its peak at 1.3525. From a technical analysis perspective, our outlook tends towards negativity. This is based on the emergence of …

Read More »USD/JPY to be monitored 13/3/2024

japanese-yen

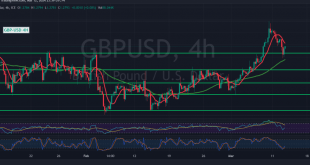

Read More »GBP may turn lower 13/3/2024

Oil, Crude, trading

Read More »Oil stuck between the direction keys 13/3/2024

In the previous technical report, we maintained an intraday neutral stance due to conflicting technical signals, coupled with trading confined within key trend boundaries. The lower boundary rested above 77.80, while the upper boundary lay below the extended resistance levels of 78.50-78.70. Technically, gold prices remained ensnared between these levels, …

Read More »Gold retesting the main support 13/3/2024

In the previous trading session, negative sentiment dominated the price movements of gold following the release of US inflation data, which bolstered the dollar’s performance at the expense of gold’s attractiveness. Today’s technical analysis reveals that the 2184 resistance level is exerting downward pressure on the price, while a closer …

Read More »Euro maintains the upward path 13/3/2024

The technical outlook for the EUR/USD pair remains consistent with a gradual upward trend, with no significant deviations observed as it endeavors to sustain its upward trajectory. Upon closely examining the 240-minute timeframe chart, it is evident that the simple moving averages continue to support the price from below, reinforcing …

Read More »CAD gradually losing momentum 12/3/2024

During the initial trading session of the week, the movements of the Canadian dollar were characterized by a limited upward trend, with the currency reaching its peak around the psychological resistance barrier of 1.3510. From a technical analysis perspective, we are inclined towards a negative outlook, primarily due to the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations