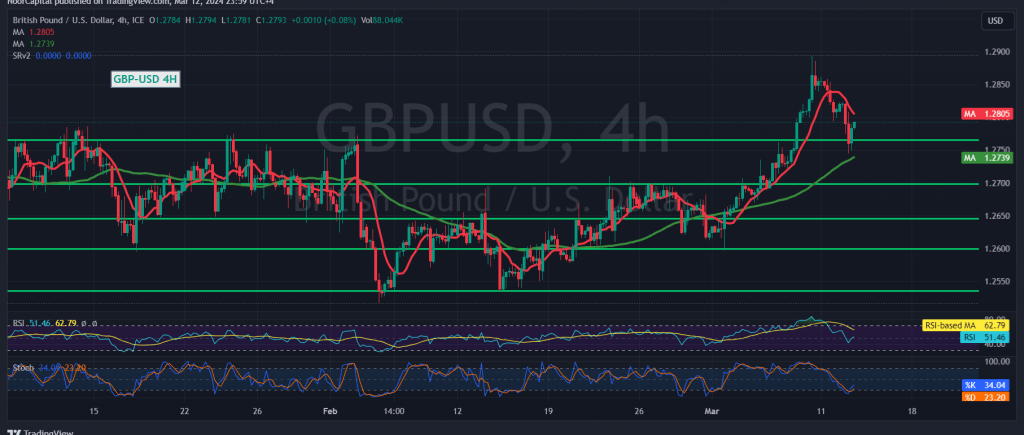

The British pound faced downward pressure against the US dollar yesterday following the release of negative economic data from the United Kingdom. Additionally, the emergence of the strong resistance level at 1.2830 compelled the pair to trade in a negative territory.

In today’s technical analysis, examining the 4-hour timeframe chart reveals the onset of negative pressure from the 50-day simple moving average, coupled with the Stochastic indicator beginning to provide negative signals.

Our bias leans towards negativity, albeit cautiously, contingent upon a clear and robust break below the 1.2750 support level. Such a development would likely pave the way for a visit to the initial target at 1.2705, with potential losses extending further towards 1.2670.

Conversely, an upward breakthrough and subsequent consolidation above the 1.2830 resistance level would immediately halt the potential downward trend. In such a scenario, the pair could swiftly recover towards targets at 1.2865 and 1.2900.

Investors should closely monitor price movements and key support and resistance levels to navigate potential market developments effectively.

Stay cautious and monitor price movements closely during these events.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations