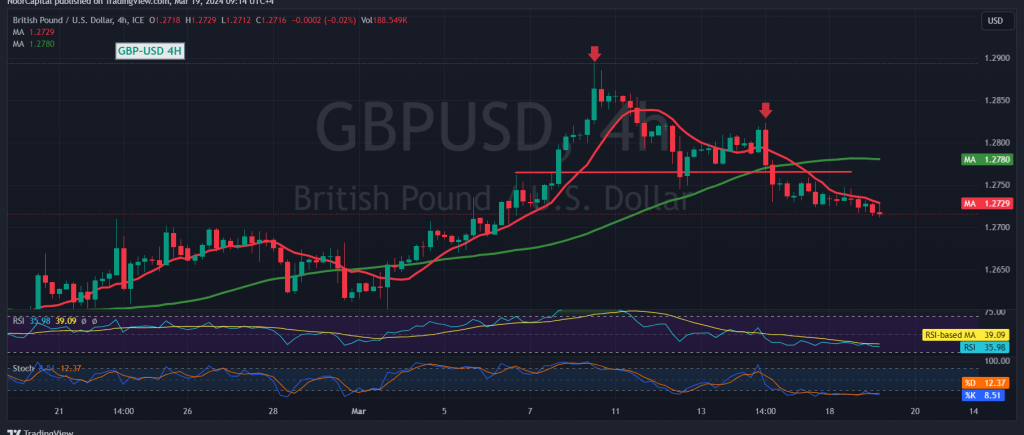

Negative sentiment prevailed in the pound sterling against the US dollar, reversing the positive outlook anticipated in the previous session, which relied on stability above 1.2760.

In today’s technical analysis, the 1.2800 resistance level exerted significant downward pressure on the pair. A closer examination of the 4-hour chart reveals the reemergence of pressure from the simple moving averages, coupled with clear bearish signals from the Stochastic indicator.

Consequently, we anticipate a bearish bias for the day, targeting 1.2705 as the initial objective. A break below this level could extend losses towards 1.2670, with further potential downside to 1.2610.

Conversely, a return to stability above the psychological resistance level of 1.2800 would invalidate the current bearish scenario, potentially prompting an upward trajectory towards 1.2860 and 1.2890.

Traders should remain vigilant, given the potential for heightened volatility in the currency pair.

Stay cautious and monitor price movements closely during these events.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations