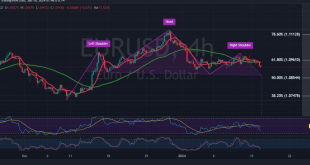

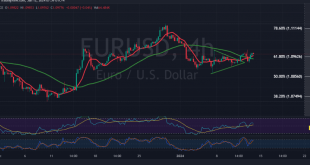

The EUR/USD pair initiated the week with a decline, encountering significant resistance around 1.0960 that prompted a negative trajectory. Presently, the pair is stabilizing near 1.0915. From a technical perspective today, examining the 4-hour timeframe chart reveals persistent pressure on the price from the simple moving averages from above. Additionally, …

Read More »Nasdaq records notable gains 12/1/2024

Oil, Crude, trading

Read More »Dow Jones Maintains Positive Momentum 12/1/2024

Oil, Crude, trading

Read More »CAD making notable gains 12/1/2024

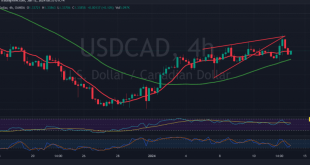

The Canadian dollar experienced an upward trend, aligning with the anticipated positive outlook outlined in the latest technical report. The currency touched the target at 1.3430 and recorded its highest level at 1.3443. From a technical perspective today, there are early signs of negativity emerging on the Stochastic indicator. Furthermore, …

Read More »USD/JPY retesting support 12/1/2024

japanese-yen

Read More »GBP/USD Sees Positive Momentum 12/1/2024

Oil, Crude, trading

Read More »Oil Show Mixed Trading, Eyes on Key Technical Levels 12/1/2024

US crude oil futures exhibited mixed trading in the previous session, eventually returning to an upward trend after finding support around the pivotal level of 71.20. From a technical standpoint, there is a cautious positive outlook. The price is receiving positive signals from the simple moving averages, which have provided …

Read More »Gold: Technical Signals Indicate Conflicting Trends, Await Key Breakouts 12/1/2024

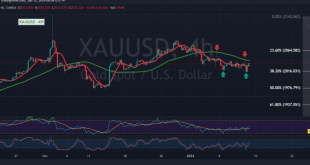

Gold experienced a downward trend in the previous trading session, testing the main support around 2016, before concluding the day’s trading above this support and embarking on an upward rebound, targeting a retest of 2035. Analyzing the 240-minute chart, conflicting technical signals emerge. The 50-day simple moving average poses a …

Read More »EUR/USD Pair Approaches Key Resistance 12/1/2024

The EUR/USD pair has initiated an assault on the primary resistance level at current trading levels around 1.0960, reaching its highest point close to the psychological barrier of 1.1000. Upon examining the 4-hour time frame chart from a technical analysis perspective, the simple moving averages provide a positive indication, supporting …

Read More »Nasdaq trying to rise 9/1/2024

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations