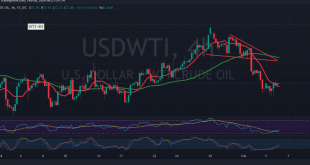

Analysis of Market Movements and Technical Indicators US crude oil futures contracts experienced mixed trading dynamics during the previous session, oscillating between upward and downward movements. The price fluctuated within a range, reaching its lowest point at $71.43 and concluding daily trading at approximately $72.74 per barrel. Market Dynamics Mixed …

Read More »Gold looking for a trend 6/2/2024

Analysis of Market Movements and Technical Signals Gold prices faced downward pressure during the initial trading sessions of the week, driven by the strength of the US dollar following robust US jobs data. Despite this decline, conflicting technical signals present a mixed outlook for gold’s trajectory. Market Dynamics Impact of …

Read More »EUR/USD Pair Resumes Bearish Trend Amid Technical Pressures 6/2/2024

The EUR/USD pair has once again succumbed to the official bearish trend, failing to sustain trading above the crucial 1.0860 level. During the previous trading session, it reached its lowest point at 1.0715, signaling a resurgence of bearish sentiment. Technical Analysis Simple Moving Averages and Fibonacci Retracement On the technical …

Read More »CAD: negative pressure exists 2/2/2024

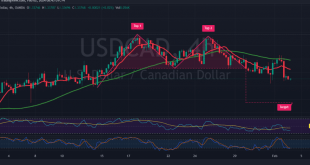

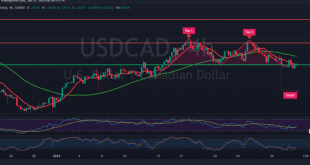

The Canadian dollar pair encountered a robust resistance at 1.3465, prompting the completion of the anticipated downward trajectory mentioned in the previous report. The pair reached the first target at 1.3380, touching its lowest point at 1.3367. In today’s technical analysis, a negative bias is observed in trading, hinging on …

Read More »USD/JPY continue to decline 2/2/2024

japanese-yen

Read More »GBP attacks the resistance 2/2/2024

Oil, Crude, trading

Read More »Oil breaks support and negativity remains 2/2/2024

US crude oil futures witnessed mixed trading during the previous session, experiencing fluctuations between upward and downward movements. The price ranged from its lowest point at $73.74 to the highest near $79.00 per barrel. A detailed analysis of the 4-hour chart reveals the simple moving averages exerting downward pressure on …

Read More »Gold continues to rise 2/2/2024

Gold prices successfully reached the initial target mentioned in the previous technical report, hitting $2065 per ounce, marking the highest level in the current upward wave. The current technical analysis suggests a potential continuation of the upward trend, supported by positive signals from the simple moving averages. Intraday trading stability …

Read More »Euro is trying to recover 2/2/2024

The euro exhibited positive momentum against the US dollar, driven by the proximity to a robust support level at 1.0770, marked by the 38.20% Fibonacci retracement. Examining the 4-hour time frame chart from a technical standpoint, the mentioned support level prompted a retest of the formidable resistance at 1.0875, coinciding …

Read More »CAD tests resistance 31/1/2024

Negative momentum dominated the movements of the Canadian dollar, coming within a few points of the first official target set in the previous report at 1.3380, reaching its lowest level at 1.3397. In today’s technical analysis, a bearish sentiment is favored in our trading outlook, relying on the intraday stability …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations