The Canadian dollar has exhibited the anticipated positive trajectory, achieving our initial target during the prior trading session, reaching a peak of 1.3529 against its counterpart. Technical Analysis Insights: Today’s technical analysis reveals the pair’s attempt to establish stability above the robust support level of 1.3500. Moreover, the Stochastic indicator …

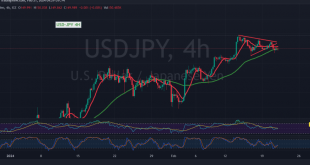

Read More »USD/JPY breaks support 21/2/2024

japanese-yen

Read More »GBP attacks the resistance 21/2/2024

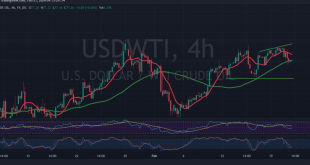

Oil, Crude, trading

Read More »Oil prices to be monitored 21/2/2024

US crude oil futures experienced a notable rally in the previous trading session, nearing the first upward target mentioned in the previous technical report at $78.70. However, the price faced resistance and retreated, reaching a peak of $78.50 per barrel before encountering downward pressure. Technical Analysis Overview Examining the technical …

Read More »Gold continues to advance, all eyes are on the Fed 21/2/2024

Yesterday, gold prices maintained their upward trajectory, aligning with the anticipated positive outlook. The precious metal touched the first target at $2027 and surged to reach a peak of $2031 during the early trading session today. Technical Analysis Perspective Analyzing the 240-minute time frame chart reveals that gold successfully retained …

Read More »Euro is trying to build an upward wave 21/2/2024

During the previous trading session, the Euro/Dollar pair witnessed predominantly positive trades, aligning with the anticipated bullish trajectory towards the official target of 1.0860. The pair reached its highest level at 1.0840, reflecting the strength of the upward movement. Technical Analysis Outlook From a technical standpoint today, examining the 4-hour …

Read More »Softening Inflation in Canada Eases Market Concerns

Statistics Canada’s latest report revealed a softening in inflation for Canada, with the Consumer Price Index (CPI) showing a decrease to 2.9% on a yearly basis in January from 3.4% in December. This figure fell below market expectations, which were anticipating a rate of 3.3%. Additionally, on a monthly basis, …

Read More »Russia Affirms Commitment to OPEC+ Quota Amid Oil Refining Decline

Russian Deputy Prime Minister Alexander Novak reaffirmed Moscow’s commitment to adhere to its quota within the OPEC+ agreement, despite a recent decline in oil refining. Novak’s statement, reported by the Russian TASS news agency on Tuesday, underscores Russia’s dedication to the collaborative effort led by the Organization of the Petroleum …

Read More »Barclays Reports Fourth Quarter Loss Amid Strategic Update

British bank Barclays revealed a net loss of £111 million in the fourth quarter of 2023, equivalent to $139.8 million, marking a significant development as the bank unveils its first major strategy update since 2016. This announcement comes as Barclays initiates a substantial restructuring effort to combat declining profits. Analyst …

Read More »European Shares Open Lower Amid Rate Cut Speculation

European shares started on a downward trajectory on Tuesday, influenced by uncertainties surrounding potential wage settlement increases in the euro zone, which could delay anticipated interest rate cuts. Additionally, China’s decision to cut mortgage interest rates failed to inspire optimism among investors. STOXX 600 Index Slips The European STOXX 600 …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations