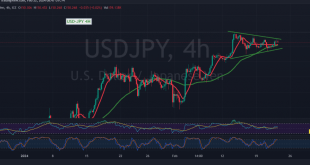

japanese-yen

Read More »GBP Trying to Break Out of the Side Range 22/2/2024

Oil, Crude, trading

Read More »Oil Trying to Recover 22/2/2024

The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark. Technical Analysis …

Read More »Gold Remains Above Critical Support 22/2/2024

In a dynamic session of trading, gold prices experienced fluctuations, influenced by the strengthening of the US dollar following the Federal Reserve Committee’s announcements. Despite initial setbacks, gold surged to reach its peak at $2032 per ounce, showcasing resilience amidst market pressures. Technical Analysis Insights A comprehensive analysis of the …

Read More »Euro Continues Positive Momentum 22/2/2024

In the dynamic world of forex trading, the Euro/Dollar pair maintains its upward trajectory, demonstrating quiet yet positive trading sessions. During yesterday’s session, the pair reached its pinnacle at 1.0832, showcasing a bullish stance. Technical Analysis Insights Delving into the technical analysis realm today, a closer examination of the 4-hour …

Read More »Oil declines as investors consider the prospects of a US interest rate cut

Oil prices faced continued downward pressure on Wednesday, extending losses from the previous session amid growing expectations that the Federal Reserve may delay interest rate reductions. These expectations overshadowed concerns about recent attacks on shipping in the Red Sea. Brent and West Texas Intermediate Decline Brent crude futures declined by …

Read More »European stocks decline under the weight of disappointing business results

European stocks experienced a downturn on Wednesday, primarily influenced by a drop in banking stocks following disappointing business results from HSBC. Investors also awaited data on consumer sentiment in the euro zone, further contributing to market uncertainty. Banking Sector Leads Decline:The banking services sector witnessed a notable 1 percent decline, …

Read More »Dollar Declines Amidst Global Treasury Bond Yield Drop Rate Cut Persists

The dollar experienced a broad decline on Wednesday, influenced by a global downturn in Treasury bond yields. Traders eagerly awaited the release of the Federal Reserve’s latest policy meeting minutes, seeking insights into the central bank’s stance on interest rates. Yen Strengthens as Dollar Dips Below 150:In Asian trading, the …

Read More »Japan’s Nikkei ends a rising wave as markets worry ahead of Nvidia’s earnings release

Investor anticipation gripped the Tokyo Stock Exchange’s Nikkei index for the second consecutive day as it failed to surpass its all-time high. With market sentiment swaying on the impending financial report from US chip giant NVIDIA, the index struggled to maintain momentum amidst global uncertainties. Market Movement:Despite an initial rebound, …

Read More »Oil rises amid Red Sea attacks and weak US interest rate cut expectations

Oil prices regained some of their gains in early Asian trading on Wednesday, as investors balanced fears of major producers reducing production and attacks on cargo ships in the Red Sea with weak expectations for a cut in US interest rates. Brent crude futures rose 12 cents, or 0.15 percent, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations