The Swiss National Bank (SNB) is anticipated to maintain its current interest rate stance until at least June, aligning with its counterparts such as the European Central Bank and the US Federal Reserve. The SNB may opt to observe its peers’ actions regarding the cessation of monetary tightening before making …

Read More »Oil Prices Hold Steady Near Four-Month Highs Amid Geopolitical Tensions

Oil prices maintained stability on Tuesday, hovering near four-month highs achieved after breaking out of range-bound trading last week. However, the specter of escalating exports from Russia, compounded by Ukrainian attacks on refineries, exerted downward pressure on prices. Price Movements The Brent crude oil futures contract for May delivery dipped …

Read More »German Investor Sentiment Surges on ECB Expectations

In a positive turn of events, German investor morale witnessed a notable uptick in March, fueled by expectations of an interest rate cut by the European Central Bank (ECB) and encouraging signs emerging from China, as reported by the ZEW economic research institute on Tuesday. Key Highlights from ZEW Report …

Read More »European Stocks Steady Amid Sectoral Shifts Ahead of Key Economic Data

European stock markets exhibited subdued trading on Tuesday, with losses in technology shares counterbalancing gains in consumer staple stocks, setting the stage for a mixed performance. The pan-European STOXX 600 index saw a marginal decline of 0.1% by 8:24 GMT, with a notable 0.6% downturn in technology shares. Economic Data …

Read More »Japanese Shares Surge as Bank of Japan Ends Negative Interest Rates

Japanese equities soared on Tuesday, propelled by the Bank of Japan’s widely anticipated decision to terminate eight years of negative interest rates. This landmark move marked Japan’s first policy tightening since 2007, signaling a significant departure from its prolonged era of ultra-easy monetary policy. BOJ’s Paradigm Shift: From Ultra-Easy Policy …

Read More »Gold Prices Nudge Down Ahead of Fed Meeting

In the Asian trading session on Tuesday, gold prices experienced a slight dip, although they maintained a position above crucial support levels. This trajectory unfolded amidst a prevailing cautious sentiment towards precious metals, particularly in anticipation of a pivotal Federal Reserve meeting slated for later in the week. Gold’s Resilience …

Read More »CAD is gradually rising 19/3/2024

The Canadian dollar’s movements during the previous trading session followed an upward trend, with the currency breaking through the resistance level at the psychological barrier of 1.3500 and reaching a peak of 1.3543. Today’s technical analysis suggests a positive outlook, with a preference for stability above 1.3500 and support from …

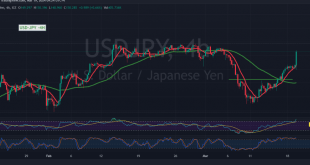

Read More »USD/JPY jumps higher 19/3/2024

japanese-yen

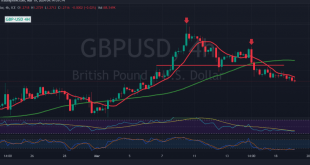

Read More »GBP continues to fall 19/3/2024

Oil, Crude, trading

Read More »Oil making notable gains 19/3/2024

Yesterday, US crude oil futures prices surged as anticipated in the previous technical report, reaching a peak at $82.46 per barrel. From a technical standpoint, our trading bias remains positive, supported by the consistent movement within the upward price channel. Additionally, the presence of the simple moving averages and the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations